- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Troubled Waters for Utility Rates

by GDS Associates, Inc | April 21, 2023 | Utility Rates

Let’s start with a thought experiment. Pick a submarine movie. Take your time, I’ll wait. Got it? Now, go ahead and picture an iconic or memorable scene from that movie. Several great sub movies from the 90s pop into mind for this Gen Xer – Crimson Tide, The Hunt for Red October, and U-571 are examples. Perhaps you went with Run Silent, Run Deep or Das Boot? Now, what are some of the iconic scenes from the movie you selected? Whatever you chose, there are few submarine movie cliches more vivid than when the sub invariably must approach crush depth to avoid detection or depth charges. Music fades, the crew goes silent, the camera focuses on the sweat dripping down their brows, and then you begin to hear the creaks of the hull as pressure builds. It’s a creepy sound and an effective way to build tension. Will she hold or will the crew meet their watery demise in an unpleasant implosion?

Let’s start with a thought experiment. Pick a submarine movie. Take your time, I’ll wait. Got it? Now, go ahead and picture an iconic or memorable scene from that movie. Several great sub movies from the 90s pop into mind for this Gen Xer – Crimson Tide, The Hunt for Red October, and U-571 are examples. Perhaps you went with Run Silent, Run Deep or Das Boot? Now, what are some of the iconic scenes from the movie you selected? Whatever you chose, there are few submarine movie cliches more vivid than when the sub invariably must approach crush depth to avoid detection or depth charges. Music fades, the crew goes silent, the camera focuses on the sweat dripping down their brows, and then you begin to hear the creaks of the hull as pressure builds. It’s a creepy sound and an effective way to build tension. Will she hold or will the crew meet their watery demise in an unpleasant implosion?

One of my favorite submarine movies does the cliché great service. In Down Periscope, Lieutenant Commander Dodge takes an old submarine exactly down to the depth where a single rivet pops from the hull, ricochets around the joint and even breaks a light bulb before coming to rest. If you haven’t seen this cinematic masterpiece, you can be forgiven. It’s a slapstick comedy with the likes of Kelsey Grammer, Rob Schneider, William H. Macy, and Rip Torn anchoring the creative spin on the submarine genre. I don’t recall seeing it nominated for an Academy Award, but it has its moments nonetheless.

Likewise, utilities right now are having to navigate troubled waters. Outside pressure from various sources are threatening to breach the financial hull. To stretch the metaphor to the point that a rivet blows, utilities are having to make difficult decisions that may determine whether they stay afloat or sink to the bottom of the abyss. Leaving the submarines behind, let’s discuss a few of the pressures that have been mounting and play a major role in how utilities are thinking about costs, financial planning, and rates. Then, we’ll explore some ways that utilities are trying to navigate through such difficult times.

COST PRESSURES

We just cannot seem to get away from the ocean, which is not necessarily a bad thing, but we all remember the images of lines of cargo ships sitting out in the ocean just a couple of years ago. That was but part and parcel of the overall supply chain trouble that has plagued the nation recently and electric utilities are not exempt. Investment in transmission and distribution infrastructure was necessary in much of the US prior to 2021. With the President signing the Investment in Infrastructure and Jobs Act in 2021, additional opportunity to invest in the grid is being realized increasing demand of components already in short supply. The result is not only significant cost increases in many components of the grid, but lead time increases as well. For instance, a study by Deloitte found a 100%-400% increase in lead time for transformers, a 60%-300% increase in lead time for cables and wires, and a 400%-600% increase for precast electric manhole covers1.

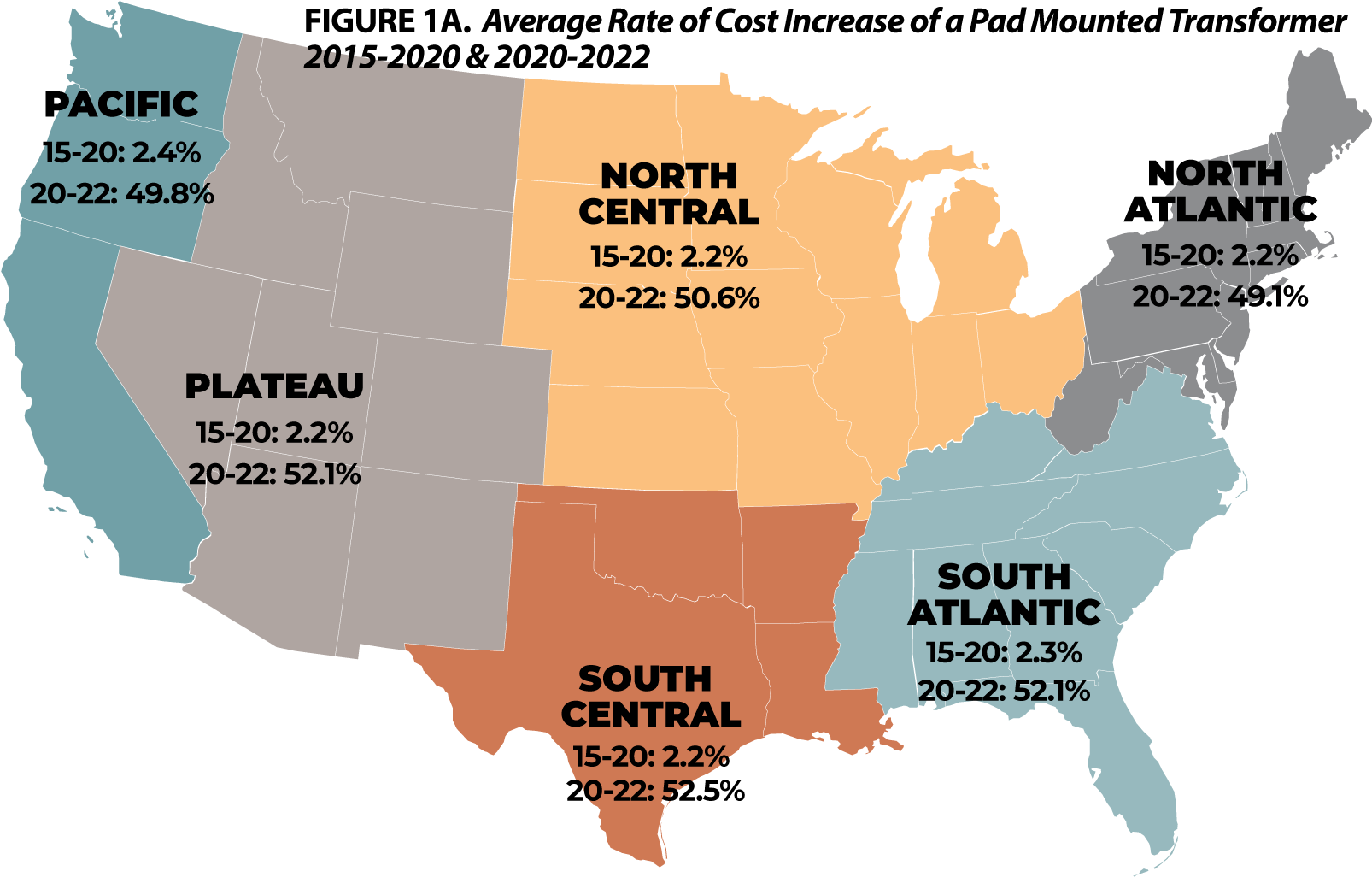

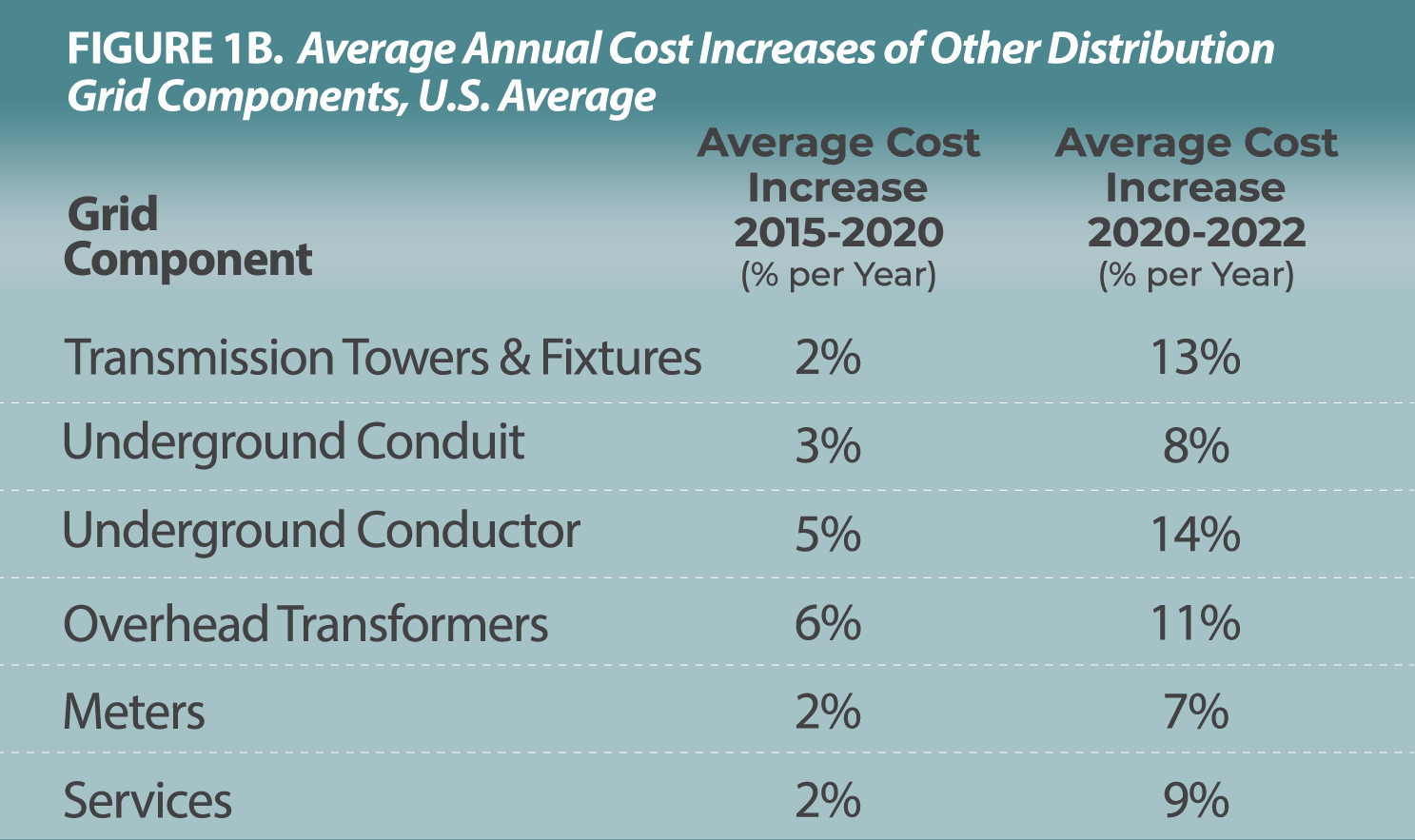

Figures 1A and 1B demonstrates the cost phenomenon. Between 2015-2020, the cost of pad mounted transformers increased at a rate of 2% per year. In the past two years, the cost has increased by an average rate of 51% per year! Less stark, but not insignificant are the cost increases of other major components of the grid.

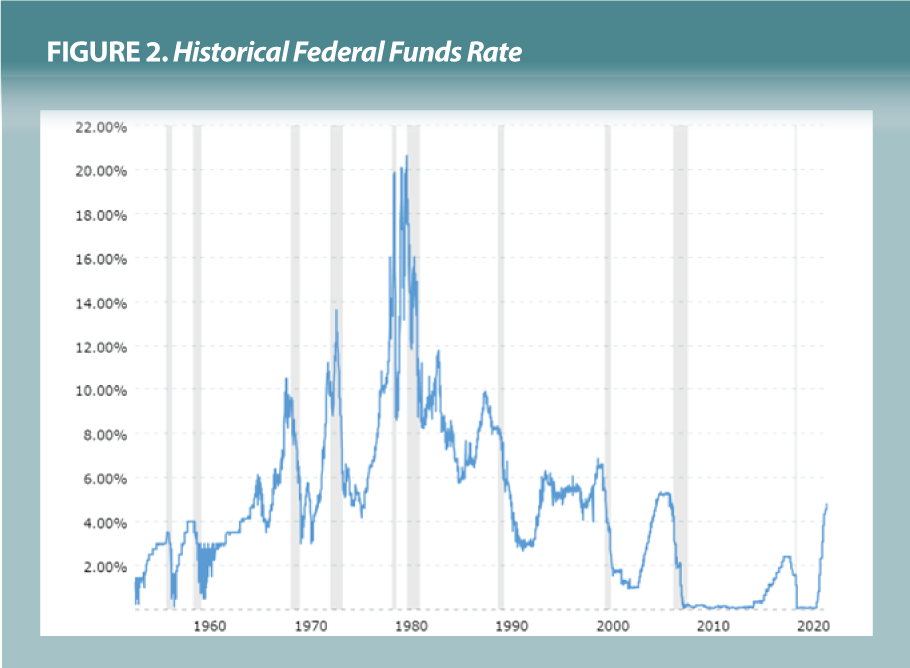

These capital costs increases will impact utility cash needs, depreciation costs in the coming years, and debt service costs. Additionally, interest expenses will be impacted by rising interest rates as the Fed has begun raising rates to try to impede the growth in inflation. In March of 2020, the Fed cut rates 150 basis points in two actions, driving the Federal Funds Rate down to a range of zero to 0.25%. Two years later, in March 2022, a series of rate increases began, with multiple increases in the range of 25 to 75 basis points such that the Federal Funds Rate stood at 4.75% to 5.00% by March 2, 2023, approaching levels not seen since before the 2008 recession. The cost of debt is increasing on top of increasing cost of capital equipment, which will have an impact on utility finances for years to come.

Other operating costs will likely be impacted by general economic conditions, including labor rates and cost of materials and supplies. Even with a moderation in January 2023, the Producer Price Index year-over-year change is at a level higher than the ten years prior to the COVID pandemic.

HOW ARE UTILITIES RESPONDING?

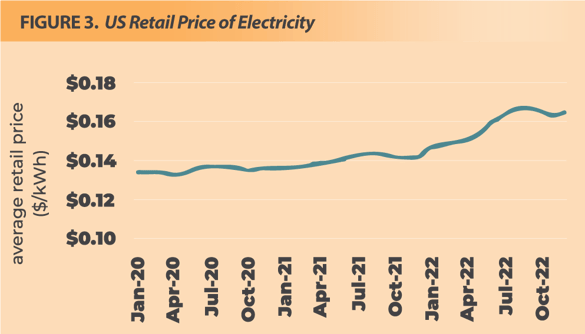

The idea of “set it and forget it” for five to ten years on electric rates is gone, at least for now. Utilities are having to take a hard look at budgets, look for ways to hedge against energy market price volatility, and take a harder look at their financial objectives. We have in recent years seen increases in retail electric rates as simply cutting costs is not sufficient to maintain grid reliability and maintain financial stability. The average retail price of electricity rose by 14.3% in 2022 nationwide, according to the Consumer Price Index. GDS has seen an increase in rate studies throughout the country, reflecting both pent up demand from delaying rate action during COVID and a need for rate adjustments in light of the cost pressures described earlier. Here are a few ways utilities are trying to respond to the cost pressures they are seeing right now.

Taking A Fresh Look At Capital Plans. If you are three years into a 5-year plan, you might want to brush it off and go ahead and think about an update. Updating costs at the very least is prudent. Likewise, trying to balance the need for construction with delivering safe and reliable power is tougher to do when inflation and increasing interest rates are compounding the impact of building on utility budgets.

Hedging Strategies. Hedging strategies can help stabilize power costs when markets are volatile.

Reserve Fund. Utilities that established reserve funds or rate stabilization plans are not immune from the cost pressures being faced today. However, they may have built reserves that allow them to draw upon that cash and request lower rate increases than a utility operating on thin cash levels.

Grant Opportunities. There may be opportunities for utilities to benefit from government investment in the grid and infrastructure, such as the ability to directly benefit from tax credits associated with solar projects and investment in electric vehicle charging infrastructure.

Multi-year Rate Plans. Many utilities are taking a 3-5 year look at rate plans and trying to levelize rate increases. A good financial forecast can help you understand scenarios and how various rate plans might impact achievement of key financial metrics such as cash levels, debt service coverage, times interest earned ratio, ability to pay capital credits, and others.

More Frequent Cost Of Service And Rate Studies. At least for now, some utilities that may have had a longer cycle between rate studies are realizing that more frequent studies are required to ensure achieving financial objectives.

For more information or to comment on this article, please contact:

Jacob Thomas, Principal

Jacob Thomas, Principal

GDS Associates, Inc. - Marietta, GA

770-799-2377 or jacob.thomas@gdsassociates.com

References

1 “Electric power supply chains: Achieving security,

sustainability, and resilience”. Deloitte Insights, September 2022.

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)