- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Survivor: The Natural Gas Dilemma Edition

by GDS Associates, Inc | December 14, 2015 | Newsletter - TransActions

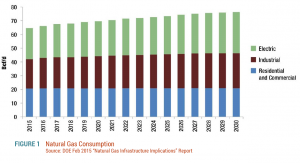

Proven shale gas reserves and fracking technology have dramatically changed the production capability for natural gas and the anticipated utilization of natural gas. Energy Tomorrow touts the U.S. as a world power in natural gas, supported by the largest energy infrastructure in the world, and utilization of natural gas in the U.S. has increased markedly over the past few years. The high levels of production, combined with the recent relatively low price levels, have made this commodity very attractive to various consuming sectors. Most notably, the power generation and industrial sectors are consuming more natural gas than ever before and are expected to continue increasing their consumption of this commodity.

Proven shale gas reserves and fracking technology have dramatically changed the production capability for natural gas and the anticipated utilization of natural gas. Energy Tomorrow touts the U.S. as a world power in natural gas, supported by the largest energy infrastructure in the world, and utilization of natural gas in the U.S. has increased markedly over the past few years. The high levels of production, combined with the recent relatively low price levels, have made this commodity very attractive to various consuming sectors. Most notably, the power generation and industrial sectors are consuming more natural gas than ever before and are expected to continue increasing their consumption of this commodity.

The EPA’s proposed Clean Power Plan adds to the popularity for the power generation sector and some estimate that there will be $100 billion worth of natural gas reliant industrial projects built along a swath that reaches from Texas eastward to Baton Rouge, Louisiana. At the same time, the U.S. is transitioning from being a modest importer of natural gas to becoming a significant exporter in the form of LNG. Although natural gas will not be the only fuel source for meeting all of the growth in the power generation sector, the growth in renewable power resources implicitly relies on natural gas resources to provide reliability support due to the intermittent nature and limited availability of existing renewable energy technologies. But as these upward trends are merging with other trends there is the potential to create discontinuities in the natural gas market.

Pipeline Investments

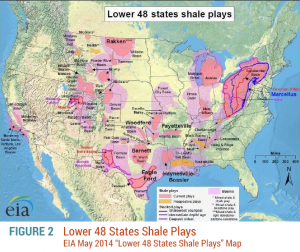

Growth in natural gas production varies significantly across the U.S. supply regions, which will create changes in the historical natural gas flows between the regions. This shift in deliverability is requiring investment and realignment of midstream and long haul pipeline infrastructure. The strongest growth of natural gas production occurred in the East fueled by the Marcellus Shale, followed by the Gulf Coast onshore region and then the Dakotas/Rocky Mountains region. Interregional flows serving downstream markets are beginning to vary significantly and thus, will require new asset investments in pipelines.

Richard Kinder, chairman and CEO of the natural gas infrastructure giant Kinder Morgan, during a keynote address at the recent IHS CERAWeek in Houston, said the growth of production in the Marcellus Shale in the last several years has had a profound effect on the flow of the commodity, which historically has flowed from the producing regions of Louisiana and Texas to markets in the Northeast. Kinder Morgan owns four major interstate gas pipelines that stretch from the Gulf Coast region of Texas and Louisiana to market areas in the Northeast. Kinder noted that his company has turned three of the pipelines around to move gas down to the Gulf Coast and the fourth one is now seeking approval to be converted into a liquids pipeline. Kinder said much of the gas from the Marcellus Shale is selling at a discount to other regions because of the shortage of pipeline infrastructure to bring it to market. FERC Commissioner Moeller, at a recent speaking engagement, stated the following regarding pipeline capacity: “When it’s really, really needed and everybody wants it…that’s when we have to be concerned about it”.

Richard Kinder, chairman and CEO of the natural gas infrastructure giant Kinder Morgan, during a keynote address at the recent IHS CERAWeek in Houston, said the growth of production in the Marcellus Shale in the last several years has had a profound effect on the flow of the commodity, which historically has flowed from the producing regions of Louisiana and Texas to markets in the Northeast. Kinder Morgan owns four major interstate gas pipelines that stretch from the Gulf Coast region of Texas and Louisiana to market areas in the Northeast. Kinder noted that his company has turned three of the pipelines around to move gas down to the Gulf Coast and the fourth one is now seeking approval to be converted into a liquids pipeline. Kinder said much of the gas from the Marcellus Shale is selling at a discount to other regions because of the shortage of pipeline infrastructure to bring it to market. FERC Commissioner Moeller, at a recent speaking engagement, stated the following regarding pipeline capacity: “When it’s really, really needed and everybody wants it…that’s when we have to be concerned about it”.

Production Infrastructure

To appreciate the impact of shale gas and fracking technology, the state of Pennsylvania (because of the Marcellus Shale) ranks 8th in the world in terms of production, even more than Saudi Arabia. The Marcellus Shale region overall produces about 20% of total U.S. natural gas production. Given the ramp up in the Marcellus Shale, Pennsylvania is poised to take the #2 spot in terms of total U.S. production behind Texas. Production from the Marcellus Shale region is now displacing inflows from the Gulf coast, the Midwest, and Canada. Bottom line is that this makes the state of Pennsylvania a swing state in terms of natural gas supply and prices. What happens in the Marcellus region now measurably impacts all of the U.S. natural gas market including Henry Hub prices. “The Marcellus has been a game changer in terms of production, reserve potential, everything,” said Fadel Gheit, a senior energy analyst for Oppenheimer & Co. in New York.

However, with the current low natural gas prices, the drilling rig count in the Marcellus Shale region has been decreasing since 2012. For example, rig counts peaked at around 140 in 2012 and has recently slipped to the mid-70s according to Baker Hughes’ tracking report. One of the largest Marcellus gas producers reported a recent quarterly loss of over $220 million and a 60% decline in profits for the year as well as announcing they were implementing a reduction in drilling. According to the Texas Railroad Commission, natural gas deliverability from all three shale fields in Texas is leveling out. Because the majority of natural gas is produced in association with natural gas liquids and crude oil, the recent fall in crude oil prices is causing a double whammy for natural gas’ deliverability outlook and adding to the discontinuity in the market. Forward natural gas prices aren’t helping producers because they are less than half of what they were just several years ago. Of course, lower natural gas prices benefit the consuming sectors.

However, with the current low natural gas prices, the drilling rig count in the Marcellus Shale region has been decreasing since 2012. For example, rig counts peaked at around 140 in 2012 and has recently slipped to the mid-70s according to Baker Hughes’ tracking report. One of the largest Marcellus gas producers reported a recent quarterly loss of over $220 million and a 60% decline in profits for the year as well as announcing they were implementing a reduction in drilling. According to the Texas Railroad Commission, natural gas deliverability from all three shale fields in Texas is leveling out. Because the majority of natural gas is produced in association with natural gas liquids and crude oil, the recent fall in crude oil prices is causing a double whammy for natural gas’ deliverability outlook and adding to the discontinuity in the market. Forward natural gas prices aren’t helping producers because they are less than half of what they were just several years ago. Of course, lower natural gas prices benefit the consuming sectors.

RTO Firm Fuel Requirements?

Not only is the natural gas supply industry talking about deliverability of the commodity, but so is the power consuming side of the commodity, including FERC and the RTOs/ISOs. In its November 20, 2014 Order, the FERC directed each RTO/ISO to file a report on the status of its efforts to address market and system performance associated with fuel assurance issues.

According to MISO’s report to the FERC, fuel availability issues can affect all generating units in the MISO footprint, potentially impacting their ability to perform and deliver energy. Although MISO states that fuel assurance is an important consideration in resource adequacy and energy market operations, and a critical factor in MISO’s ability to reliably meet customer’s electricity needs under a wide range of operating conditions, MISO believes load serving entities, with oversight by the States as applicable by jurisdiction, are primarily responsible for ensuring resource adequacy. A fuel survey conducted by MISO shows that of the 53,000 MW of generators that responded, only about 15% of them had firm natural gas pipeline deliverability arrangements.

According to MISO’s report to the FERC, fuel availability issues can affect all generating units in the MISO footprint, potentially impacting their ability to perform and deliver energy.

According to PJM’s report, the most significant initiative to improve fuel assurance in the PJM region is PJM’s capacity performance plan which has just recently been approved by the FERC. Under this arrangement, owners and operators of generation capacity resources would have strong economic incentives to invest in fuel assurance, including firm fuel transportation arrangements. PJM will make capacity market offer caps more flexible so as to allow fuel assurance costs to be included in sell offers. The would pair the additional flexibility to include costs associated with such investments with more severe economic consequences for resource non-performance, including lack of firm fuel arrangements. PJM believes the combination of increased offer flexibility and significant consequences for non-performance will encourage sellers to invest in firm fuel arrangements.

Pipeline Commitments

Outside of electric utilities, other gas consuming sectors are beyond being encouraged; they’ve made firm commercial commitments as was confirmed by Kinder during his keynote talk when he said investors, such as petrochemical industrial customers in Texas and Louisiana, have moved to lock in deliverability rights. These deliverability arrangements are year round, firm base load deliveries and gas producers are now looking to do the same. In the past, the natural gas distribution sector would sell its year round contracted capacity during non-winter months, mainly to the power generation sector, but new pipeline capacity will not be released. Like the turnaround in the direction of pipeline flows, this non-released capacity will also be a turnaround from the norm and adds to the deliverability discontinuity dilemma.

Conclusion

In light of all of these conflicting trends, natural gas consumers need to do their due diligence on the expected reliability of their natural gas deliverability and address any potential unfavorable discontinuities. This starts with supply contracting and ends with delivery point transport. Work to be done includes:

- Evaluating firmness of supply arrangements, the liquidity of supply points, and assessing potential price basis exposure;

- Evaluating the subscription level of the delivering pipeline in addition to evaluating the pipeline’s balancing arrangement and associated imbalance costs;

- Assessing gas requirements on an hourly/daily/monthly basis,managing daily gas swings, and optimizing gas arrangements and capabilities; and,

- If necessary, developing appropriate meter point allocations for the end gas users.

Natural gas consumers should proactively plan and be prepared to conduct commercial transactions for supply and transportation and potentially, develop unique, custom solutions. GDS recently assisted a client with implementing a custom solution, which was to arrange pipeline deliverability through a single meter for multiple power generating units (at the same plant site) that were dispatched separately by different owners who have separate supply and transport arrangements. Reliable natural gas arrangements extends beyond just the physical natural gas commodity and includes energy management sourcing and contracting, price hedging, and risk management.

For more information or to comment on this article, contact:

Paul Wielgus, Managing Director | CONTACT

Paul Wielgus, Managing Director | CONTACT

GDS Associates, Inc. – Marietta, GA

770.425.8100

DOWNLOAD PDF

Also in this issue: Distributed Generation: Making a Deal Between Opportunities and Challenges

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)