- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

SEEM: Energy Market Lite for the Southeast

by GDS Associates, Inc | August 17, 2020 | News , Transmission

The Southeast Energy Exchange Market, or SEEM, may look like an energy imbalance market from the outside, but a look under the hood reveals a different story.

A Great Plains History Lesson

Energy imbalance markets have been precursors to the transition to a Regional Transmission Organization. In the Southwest Power Pool, the Energy Imbalance System introduced hourly prices for the differences between schedules and actual requirements for individual generators using a Locational Imbalance Price. The LIP, as it was called, was basically a Locational Marginal Price but was only applied to imbalance energy, and not the entire delivered or consumed power requirement. Within a few years, SPP built upon the EIS platform and evolved into a full-blown energy market.

The Western Transition

More recently, the Western Interconnection has seen the spread of the CAISO Energy Imbalance Market into Arizona, Nevada, Utah, Idaho, Washington and Oregon, with expansion into Montana, Colorado and New Mexico over the next two years. The EIM structure is similar to the SPP Energy Imbalance System with the use of locational prices for calculating a real time price for schedule deviations.

The Southwest Power Pool has taken lessons learned from their EIM development and is preparing to roll out a Western EIS, but that effort has slowed down due to regulatory concerns regarding their tariff. The WEIS still maintains a structure that relies on an intra-hour LMP price signal for any generator or load located within a participating Balancing Authority.

A Southeast Perspective

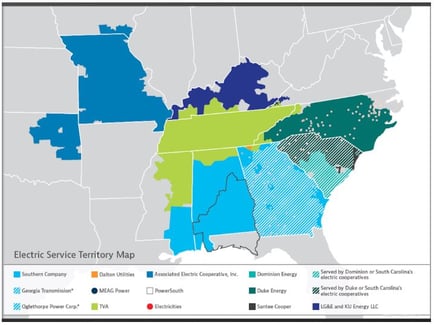

Map of utilities involved in SEEM discussions, courtesy of Charlotte Business Journal

Whether or not it has been intentional, Southeast utilities have been unsuccessful in achieving any sort of regional transmission organization or independent system operator. Initiatives like GridSouth and SETrans did not get off the ground for various reasons.

It appears that Southern Company and Duke Energy are now spearheading the SEEM effort with input from other regional utility stakeholders. Unlike the aforementioned Western EIM and SPP EIS, initial reports regarding SEEM indicate that this initiative does not appear to possess many of the qualities that result in significant savings with real-time balancing markets such as transparency, liquidity and competition.

Things to Consider

- Pricing: Under SEEM, it appears utilities will communicate their bids to either sell excess generation or to purchase to cover deficiencies. The cost of power does not have to be based in reality, but only what the “market” will bear. This type of automated, bid-based “split the savings” system was a hallmark of the Florida grid going back to the 1980’s and proved to be an effective way to transact prior to FERC Order 888. A Locational Price structure, such as what is used it RTOS throughout the continental US, is designed to put downward pressure on prices which results in greater savings to consumers.

- Deliverability: With an automated, bid-based system between Balancing Authorities, SEEM transactions would likely require real-time assessments of infra-hour Available Transfer Capability and approval of eTags. With both the CAISO and SPP EIMs, transmission is non-firm, “as available” and is priced at zero cost. The cost and curtailment priority of SEEM transmission versus other non firm products is something that will need clarity.

- Participation: There are still questions to be answered with respect to who gets to be part of SEEM. LMP-based systems allow for all generators to have their imbalances settled with a real-time price signal. If third parties are not allowed to bid or if third parties have to procure an intra-hour transmission product on a 15-minute, then the only way they could take advantage of SEEM is to be a designated network resource of a participating utility.

The GDS View

There is still much more to be done before a full assessment of SEEM can be performed. We expect that further discussions with state utility commissions must occur, particularly in the Carolinas where the state legislators are already pushing for regional transmission organizations and real-time energy markets. It is anticipated that economic studies to assess benefits are forthcoming soon which means that there will be winners and there will be losers. Eventually, market rules and tariffs will need to be filed with FERC, which will require detailed evaluation of the impacts on those who did not have a seat at the table. The regulatory pressure to move the Southeast toward an RTO will likely grow as more renewable generation penetrates the region. Our recommendation is to identify your strategic goals, find any allies and be ready to move quickly.

For more information or to comment on this article, please contact:

For more information or to comment on this article, please contact:

John Chiles, Principal-Transmission Services | CONTACT

GDS Associates, Inc. – Marietta, GA

770-799-2423 or john.chiles@gdsassociates.com

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)