- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Part II: FERC ROE Policy In A Flux - What's Happening and Why It Matters

by GDS Associates, Inc | August 22, 2019 | News , Newsletter - TransActions

The Federal Energy Regulatory Commission’s (“FERC” or the “Commission”) policy on Return on Equity (“ROE”) is in a flux following a proposal to drastically change how it determines just and reasonable ROEs. Part One of this two-part series outlined the details of the newly proposed framework which involves a change from a solitary reliance on the Discounted Cash Flow (“DCF”) method to using multiple analytical methods in determining a just and reasonable ROE. This article explains how this represents a major shift in policy and provide cautionary reminder that determining a just and reasonable rate requires a careful balance of investor and consumer interests. Additionally, we highlight the importance of ROE’s contribution to transmission charges as it’s expected to increase with growing transmission

capital expenditure. Finally, we discuss the options available to transmission customers to ensure ROEs are just and reasonable.

Major Shift in ROE Policy

The Commission’s proposed framework represents a major shift in policy on a number of fronts. First, the Commission has relied exclusively upon the DCF methodology for several decades, since the early 1980s, to determine a just and reasonable ROE for a public utility. Even its decision in Opinion No. 531 was ultimately within the confines of a range of reasonableness determined by the DCF method. Second, putting any weight on an accounting return method, such as the Expected Earnings method, which is completely devoid of market input, violates the Commission’s long-standing view that the best way to meet the standards set out in the landmark Bluefield (1923) and Hope (1944) Supreme Court decisions is through the application of a market-based cost of capital estimate (e.g. the DCF method). Third, in Opinion No. 531, the Commission expressed concern regarding the reliability of the non-DCF methods it is now proposing to directly utilize and concluded that they were “sufficiently reliable – not to set the ROE itself – but rather to corroborate our decision.” Therefore, it is quite a change to now propose to directly rely upon these alternative methods in the determination of the ROE. At the very least, significant modifications to the way the methods were applied in Opinion No. 531 is warranted and required. From a review of FERC trial staff’s testimony filed in the paper hearing proceedings, it is clear that they also consider that significant modifications will be necessary.

Just & Reasonable ROEs – A Balance of Investor and Consumer Interests

In two landmark decisions, known as Bluefield and Hope, the Supreme Court established standards for regulatory determinations of allowable rates of return on common equity capital which the Commission follows. Importantly, these standards recognize that ratemaking involves a balancing of investor and consumer interests, and that the equity investor’s interest is served if the return to the equity owner is comparable to the returns on investments in other enterprises having similar risks. In addition, the Court’s standards support an ROE that is sufficient to ensure confidence in the financial integrity of the enterprise so as to maintain its credit and to attract capital. The consumer interest is described as including protection from “exploitation at the hands of” the utility. It goes without saying, that investors in utilities want a high ROE rate and that consumers want a low ROE, but ultimately a necessary balance ensures a sustainable and mutually beneficial arrangement supporting the provision of transmission service, a critical public good.

However, a wholesale transmission customer should be concerned about the direction of the newly proposed framework, including the particulars of how each methodology is employed, and whether it will simply result in an unjustified increase of ROE rates. If one were to take a cynical view, it can be seen that there are distinct similarities between the views expressed by the Edison Electric Institute, an advocacy group for investor-owned utilities, in its December 2017 whitepaper calling for the Commission to revisit its reliance on the DCF methodology, and the resulting proposed framework put forward by the Commission. Furthermore, the Commission’s orders and notice of inquiry emphasize the need to ensure that the capital attraction standard is met but omits to mention that setting a just and reasonable ROE involves a balancing of investor and consumer interests. The importance of this balance is not lost on leaders of the electric utility industry, with FirstEnergy Corp. president and CEO, Charles Jones, Jr., saying during the February 20, 2019 earnings call, that “Good investments are formulaic mechanisms at transmission…that lead to the improvements that we’re making to also serve customers, and you’ve heard me say this before good investments are the ones customers are willing to pay for and shareholders are willing to invest in.” It is critical that this required balance is not overlooked.

With Growing Transmission Capital Expenditure, ROE’s Importance in Transmission Charges is Expected to Increase

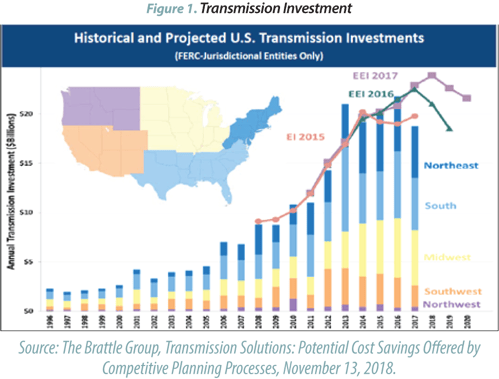

The transmission system has experienced a significant and sustained level of investment over the past 10 years. The is readily apparent from Figure 3 below which shows yearly utility investment in transmission infrastructure was around $10BN in the late 2000s to $20BN in each of the last five years. This is significantly up from the $2BN a year level seen in the 1990s. The drivers for this investment can be summarized into three broad categories: (1) aging infrastructure replacements and upgrades, (2) integration of new renewable and gas-fired generation, and (3) system resiliency, security, and protection. Additionally, investment in transmission facilities under FERC’s jurisdiction is clearly an attractive proposition. For example, in late 2018, FirstEnergy Corp. exited its troubled non-regulated businesses and become an entirely regulated company. Moreover, it’s president and CEO, Charles Jones, Jr., during the February 20, 2019 earnings call, praised the virtues of investing under FERC approved transmission formula rates and distribution real-time riders when he said the company’s planned investment growth of 6-8% a year “does not depend on any rate cases in order for us to achieve that growth; it’s merely executing the plan, investing in these formula-driven mechanisms and the growth will occur.” These comments demonstrate the attractiveness of low-risk guaranteed return formula-driven mechanisms to investors.

The ROE component of a utility’s FERC approved transmission formula rate accounts for a significant part of the overall revenue requirement. The ROE component is a function of the ROE rate times the rate base and acts as the utility’s profit, from a regulatory perspective, as all the other components are cost past through items e.g. Operations and Maintenance expenses, depreciation expense and taxes. Additionally, the tax gross up needed to keep a utility whole is a direct function of the ROE return. Taking PSE&G’s 2017 actual annual transmission revenue requirement as an example, we see that PSE&G was entitled to an ROE return of $441.5M which amounted to 36% of its overall net revenue requirement of $1.25BN. The specific contribution from the ROE return to the overall revenue requirement will vary from utility to utility but its contribution is always significant. Therefore, given the dollars involved, it is critical that ROE rates are just and reasonable.

Moreover, cooperative and municipalities can see real savings from a reduction in the ROE rate. For instance, under the PSE&G 2017 formula rate, if a cooperative or municipal has peak load of 200 MW, as measured for transmission service, its transmission charge would be $24.75M. If the base ROE were reduced by 100bps, from 11.18% to 10.18%, the charge would be reduced to $23.45M, a reduction of $1.3M or 5% (note for simplicity this example ignores any interactions related to regional PJM projects). Additionally, this would be an annual savings, until the ROE rate was changed once again, and its effective value would increase as the transmission rate base increases.

What Avenues are Available to Ensure Just and Reasonable ROEs?

There are two primary regulatory avenues directly related to the ROE that a cooperative or municipality can pursue depending on whether the ROE is an existing ROE or a one that is newly requested by the transmission utility.

1. Regarding an existing ROE included in a FERC regulated formula rate, a customer can challenge the just and reasonableness of this rate on the basis that the economic environment and capital markets have changed substantially since the time the ROE was approved. While the Commission’s proposal includes a rebuttable presumption that existing ROEs are just and reasonable if it is within a certain bandwidth, this restriction and the various ROE methods proposed to be used to develop the bandwidth are not yet finalized. Therefore, pending finalization, it is difficult to assert how restrictive this viewpoint will ultimately be.

2. Separately, customers have an opportunity to challenge a new requested ROE as part of a FERC regulated formula rate filing by protesting this aspect, along with other aspects of the formula rate. The burden is on the transmission owner to justify the just and reasonableness of the requested ROE. Importantly, the Commission has proposed to apply the rebuttable presumption of just and reasonableness only to existing ROEs and NOT new ROE requests.

There are also alternative non-ROE routes available to hedge against increasing transmission charges or other FERC regulated formula rates. One approach is to participate in the annual review of the transmission formula rate true-ups or updates and challenge items that are inappropriately included in the rate. These efforts may result in significant savings. For example, a review may identify that distribution expenses are erroneously included in transmission regulatory accounts.

Conclusion

The Commission’s proposed new ROE framework represents a major shift in its policy direction and is expected to result in an increase in ROEs if adopted as-is. The Commission, transmission customers, and other stakeholders will need to closely scrutinize its merits as part of the hearing and notice of inquiry proceedings to ensure the policy continues to balance the interest of investors and customers as set out by the landmark Supreme Court decisions. It will likely take a number of years before the Commission’s policy will be affirmed. In the meantime, industry players will need to work within the confines of this non-finalized policy. Given the significant role that ROE plays as part of the overall transmission charges, and its ever-increasing importance due to continued investment growth in the transmission network, cooperatives and municipalities would benefit from pursuing available avenues to ensure that ROEs are just and reasonable.

For more information or to comment on this article, please contact:

Breandan Mac Mathuna, Senior Project Manager | CONTACT

Breandan Mac Mathuna, Senior Project Manager | CONTACT

GDS Associates, Inc. – Marietta, GA

770.799.2391

Download PDF

Also in this issue: Energy Efficiency in EUI

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)