- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

The Next Evolution of Residential Rates

by GDS Associates, Inc | December 10, 2015 | Newsletter - TransActions

Success depends upon previous preparation, and without such preparation there is sure to be failure. – Confucius

Success depends upon previous preparation, and without such preparation there is sure to be failure. – Confucius

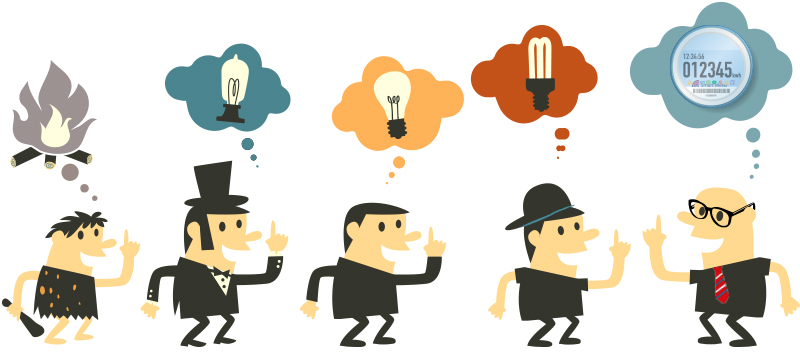

Not long ago, a man with a South African accent proclaims to an excited LA auditorium that he is there to announce “a fundamental transformation in how the world works”. Elon Musk continues, introducing Tesla Motors’ newest foray into energy storage: the Powerwall home battery. Residential energy storage in 7 or 10 kWh slugs in a box roughly 3’ x 5’ in size. Traditionally, residential rate design has done an imperfect job of recovering fixed costs appropriately. For decades, the standard residential rate has consisted of a customer charge and a consumption-based charge. The customer charge is a fixed amount billed each month regardless of energy consumption. There are, of course, many different forms this basic model can take, but the key fact is many fixed costs1 are recovered through the variable rate component (e.g. the energy charge). There were several reasons this was (or, more likely still is) the case, including lack of affordable interval metering technology.

As a result, when electricity consumption declines in the residential class (due to, say, mild weather), fixed cost recovery is hampered because so much of the price is tied to consumption. With residential revenues making up a significant portion of total revenues, utilities can experience tough financial times when residential sales are down. Furthermore, advances in technology that give customers the ability to replace or reduce electricity they used to buy from the utility threatens the cost recovery under traditional rates.

A couple of empty-nesters go on a camping vacation and discover solar-powered camping gear. A few weeks later, they’ve transformed their fascination with the gear into purchase of solar panels on the roof of their rural home. Their first order of business is to call the electric coop and ask for “one of those meters that spins forward and backward.”

In a typical electric cost of service study, there are three kinds of fixed costs: customer costs, generation and transmission demand costs, and distribution demand costs. Customer costs are represented by the costs associated with producing a bill and by a theoretical minimum plant investment associated with serving a first kilowatt-hour to a customer. Distribution system demand costs are costs associated with the additional investment in excess of the minimum plant.

In a typical electric cost of service study, there are three kinds of fixed costs: customer costs, generation and transmission demand costs, and distribution demand costs. Customer costs are represented by the costs associated with producing a bill and by a theoretical minimum plant investment associated with serving a first kilowatt-hour to a customer. Distribution system demand costs are costs associated with the additional investment in excess of the minimum plant.

Quite a few utilities are beginning to increase the monthly customer charges in their residential rates. This is a first step toward better aligning recovery of customer-related costs through fixed prices. Even making a large increase in the customer charge to fully recover all customer-related costs is still leaving a large portion of fixed cost recovery in energy charges. Remember the distribution demand costs.

Another problem with increasing just the customer charge is that it is a “one size fits all” approach which may negatively impact sensitive customer types such as those on a fixed income, low income, or low use customers. Low use and low demand consumers may be unfairly impacted if a utility’s customer charge exceeds the customer-related costs and begins to recover some demand-related costs as well.

A Millennial has been raised in an environment of energy efficiency and conservation. He looks forward to a day without an electric grid, convinced he’ll see it in his lifetime. In the meantime, he’s well aware he needs the power produced by the local municipality to support his connected, tech-heavy life. However, he looks for every opportunity to enact the latest generation of efficient products and behaviors in his condo while adding consumer electronics to his stockpile at a rapid pace.

So, what do the Powerwall, solar panels, and conservation behaviors have to do with residential rate design? These all expose the weakness of recovering fixed costs under traditional residential rate structures. Consider, for example, that one industry analyst thought it possible that a Powerwall coupled to a solar panel array might result in a homeowner that buys little to no power from the utility during summer months and buys a lot in the winter. Imagine those distribution facilities sitting idle for months at a time! And, according to the Solar Energy Industries Association (SEIA), residential solar has posted annual growth rates over 50% in 2012, 2013, and 2014.2

In response to these challenges, utilities are beginning to seriously consider residential demand rates as a viable option. In the past, just the mention of such could result in visions of pitchforks and flaming torches. But now, it’s a brave new world and one in which better aligning prices with cost causation not only makes a lot of sense but may be vital to financial survival. But moving in the demand rate direction is not a simple matter, like an aircraft carrier changing course. Several challenges await the progressive utility manager who begins to investigate residential demand rate design.

Utilities are beginning to seriously consider residential demand rates as a viable option.

If not already deployed, utilities will soon be moving toward deployment of AMI and will therefore have the capability to measure demands at the individual household level. But defining the billing demand to use in a rate can be challenging. For instance, just a couple of the pros and cons associated with using a non-coincident or a coincident peak demand are shown in Figure 2.

Data quality and availability may also be an issue. A manager may think his utility is collecting and storing interval data with regular back-up. However, he may find the available data the utility currently has to conduct a cost of service and rate design is not as robust as he thinks. As utilities roll out AMI, they should give careful consideration to proper data capture and storage as a step toward planning for future needs for the data.

Data quality and availability may also be an issue. A manager may think his utility is collecting and storing interval data with regular back-up. However, he may find the available data the utility currently has to conduct a cost of service and rate design is not as robust as he thinks. As utilities roll out AMI, they should give careful consideration to proper data capture and storage as a step toward planning for future needs for the data.

As utilities think about residential rates and fixed cost recovery, the prudent ones would begin to explore demand rates even if they prefer to let other utilities “test the waters”. An evaluation process can help identify and answer many of those tough questions and give a utility the time to give them full consideration before the utility’s finances are threatened. Pilot programs can help utilities craft educational materials and measure customer responses to rate alternatives. Energy storage won’t be prevalent in many homes in just a few years and net metering policies can protect exposure to the solar risk in the near term. There is still time to move with careful consideration, but exploration may be a good idea nonetheless.

Sources

1. Those costs that do not vary with the amount of energy consumed by the consumer, such as distribution system investment or capacity costs.

2. U.S. Solar Market Insight®, Executive Summary, accessed at: https://www.seia.org/research-resources/solar-market-insight-report-2014-q4

For more information or to comment on this article, please contact:

Jake Thomas, Senior Project Manager | CONTACT

GDS Associates, Inc. – Marietta, GA

770.425.8100

DOWNLOAD PDF

Also in this issue: OATT Ancillary Services

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)