- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Long Term Performance - Battery Energy Storage Systems

by GDS Associates, Inc | March 18, 2021 | News , Energy Use & Efficiency , Newsletter - TransActions

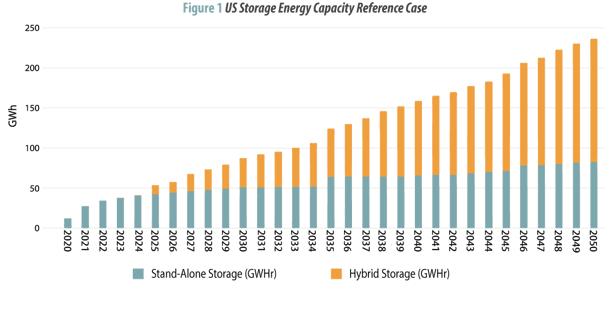

Battery Energy Storage Systems (BESS) are currently being deployed in virtually every corner of the United States, and even in the middle of the economic downturn, analysts’ projections indicate this trend will continue. The primary drivers of this change are technology improvements, BESS cost reductions, and the growing market for energy storage services. The energy storage industry launched in the US several years back with stand-alone assets serving markets such as frequency regulation and new use-cases are now meeting the needs of the changing grid. The performance of lithium-ion batteries has been proven to be economical for a growing number of energy storage services. We have all watched the power industry shift towards renewable power generation and the stage has been set to introduce a large number of energy storage systems(1) where lithium-ion is expected to dominate while innovative products promise even lower costs in future years. Batteries will continue to be deployed as stand-alone assets, however, that growth is expected to flatten out as hybrid renewable plus battery storage systems become part of the power generation growth engine.

Battery Energy Storage Systems (BESS) are currently being deployed in virtually every corner of the United States, and even in the middle of the economic downturn, analysts’ projections indicate this trend will continue. The primary drivers of this change are technology improvements, BESS cost reductions, and the growing market for energy storage services. The energy storage industry launched in the US several years back with stand-alone assets serving markets such as frequency regulation and new use-cases are now meeting the needs of the changing grid. The performance of lithium-ion batteries has been proven to be economical for a growing number of energy storage services. We have all watched the power industry shift towards renewable power generation and the stage has been set to introduce a large number of energy storage systems(1) where lithium-ion is expected to dominate while innovative products promise even lower costs in future years. Batteries will continue to be deployed as stand-alone assets, however, that growth is expected to flatten out as hybrid renewable plus battery storage systems become part of the power generation growth engine.

Lithium-ion battery systems are being constructed with long-term contracts where delivering certainty on project proforma is key to sustained growth. Many operators are gaining experience with managing the health of large-scale lithium-ion batteries through the proper design and management of battery health parameters. Degradation of the energy capacity is probably the most important operational and maintenance factor to consider for the life of the asset. The degradation of the batteries will occur if the battery is cycling, but also while it is sitting idle, which is called calendar degradation. Energy capacity degradation is a function of both cycling and calendar components which can be separated out for project proforma development and managed during operation.

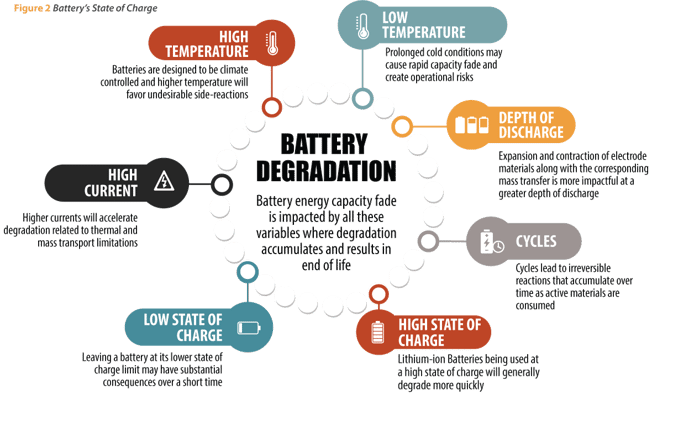

Degradation characteristics can be complex and contractual energy capacity guaranties require that operational conditions be meet such as controlling the air temperature of the container, managing the state of charge, and limiting the cycling. The primary factors of a battery degrading are (1) depth of discharge (2) number of cycles (3) temperature (4) state of charge and (5) the current (illustrated in Figure 2). Most energy capacity warranties will specify the annual cycles and energy per cycle. The energy per cycle can also be viewed as the depth of discharge where the battery is partially discharged to provide the correct duration for the use-case. The battery undergoes strain and irreversible reactions when there is a depth of discharge which results in incremental damage depending on how deeply the battery is drained. Running the battery hotter will favor those irreversible reactions so designing a battery container with a robust climate control system is critical to long term performance. On the other end of the spectrum, extreme cold conditions may result in catastrophic damage to the battery which can be a concern during extended auxiliary power outages in northern climates.

The battery’s state of charge, or amount of energy in the battery at a given moment can also be an important aspect to manage long term performance. Lithium ion batteries tend to degrade less when operated at a lower state of charge. A high state of charge may contribute to side reactions even while the battery sits idle. The electrodes are constantly being attacked by the aggressive organic electrolyte contained in most lithium ion cells, and a high state of charge accelerates that process.

Every lithium-ion product has an ideal state of charge window which is starting to get reflected in many Operations Agreements. Although a low state of charge can reduce degradation, minimum state of charge values needs to be controlled and stranded batteries are at

risk of suffering serious side effects. Electrolyte improvements are resolving some of these issues with products currently making their way into OEM roadmaps such as solid-state lithium-ion. The large number of lithium-ion products tends to add complexity to project equipment selection to create a project with the best balance of performance and cost. There are two favors of lithium-ion that have emerged to become the most deployed grid chemistries, Lithium Ferrous Phosphate (LFP) and Nickel Manganese Cobalt (NMC). Battery manufacturers have tuned these products to deliver robust cycle life and reliable performance. The exact battery recipe for NMC and LFP products is dependent on the manufacturer which may deliver slightly different performance characteristics. When it comes to lifecycle management, the energy storage batteries from Tier One suppliers have competitive performance metrics with a few nuances. LFP batteries are known for their robust cycle life in long duration applications and low risk of thermal events but installations will have a relatively larger footprint. NMC batteries are a good fit for most short and long duration use-cases making them a versatile and widely deployed product. Many stand-alone projects are being developed for markets where a 15+ year lifetime is a typical contract.

Other hybrid assets such as solar plus storage may have 30-year proforma based on the useful life of the photovoltaic panels and other major equipment. Invariably, the batteries will reach end of life and require replacements with a new technology. The decommissioning and recycling of the batteries is a critical piece of BESS projects to assure environmental stewardship. The costs of decommissioning a BESS project and disposing/recycling battery equipment at the end of a BESS project’s useful life is related to the

salvageable metals that vary depending on battery chemistry.

NMC and LFP are composed of different metals, as their names clearly denote, and the end of life costs will vary depending on the content. The chemistry blend of NMC is based on the mix of metals (Nickel, Manganese, and cobalt) and suppliers have stricken the right balance of materials to reduce costs and deliver expected performance. NMC has progressed to contain less cobalt than its predecessors by moving to a blend that is richer in Manganese and Nickel. The cobalt has the highest salvage value so end of life costs for these

installations have been trending upwards to dispose of this Class 9 Hazardous waste. LFP has even less salvage value related to the limited value of the iron and phosphate compounds. Decommissioning costs were not always considered in the early installations and this continues to evolve along with the recycling industry. It is becoming common for the end of life responsibility to lie with the Engineering Procurement and Construction (EPC) contractor. The landowner does bear some liability as the Environmental Protection Agency (EPA) deems the landowner responsible for removed equipment. Strong decommission planning and cost analysis are becoming an important part of satisfying requirements of project financing and used for depreciation filings. There are currently no facilities in the US that fully recycle lithium-ion batteries to return the commodity back into the market. Market demand for recovered materials is expected to strengthen as US battery manufacturing expands and best practices are established. The economics of recycling has some uncertainty but is likely to remain a material cost to the project. Managing a BESS asset to meet long-term performance expectations is a matter of understanding the degradation impacts, executing equipment maintenance, and budgeting for the costs throughout the system’s lifetime. The different types of lithium-ion batteries will have design and cost variables that can be understood during the project’s development. The battery industry is poised to become an important part of the US power supply and while best practices continue to emerge, the industry has made significant strides in cost analysis and equipment lifecycle management.

For more information or to comment on this article, please contact:

Matt Smith, Senior Project Engineer | CONTACT

Matt Smith, Senior Project Engineer | CONTACT

GDS Associates, Inc. – Marietta, GA

770-799-2578 or matt.smith@gdsassociates.com

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)