- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Key Takeaways from FERC's Final Rule on the Treatment of TCJA Effects in the Development of Transmission Rates

by GDS Associates, Inc | February 12, 2020 | News , Newsletter - TransActions

On November 21, 2019, the Federal Energy Regulatory Commission (“FERC” or “Commission”) issued Order 864, a final rule that addresses the impact of the Tax Cuts and Jobs Act of 2017 (“TCJA”) on accumulated deferred income taxes (ADIT) recovered under wholesale transmission rates (the “Final Rule”). In the Final Rule, the Commission imposed several new requirements for transmission formula rates, avoided making any generic rule(s) applicable to transmission stated rates, and generally guaranteed that treatment of excess and deficient ADIT will be an important consideration in transmission rate filings in 2020 and beyond.

On November 21, 2019, the Federal Energy Regulatory Commission (“FERC” or “Commission”) issued Order 864, a final rule that addresses the impact of the Tax Cuts and Jobs Act of 2017 (“TCJA”) on accumulated deferred income taxes (ADIT) recovered under wholesale transmission rates (the “Final Rule”). In the Final Rule, the Commission imposed several new requirements for transmission formula rates, avoided making any generic rule(s) applicable to transmission stated rates, and generally guaranteed that treatment of excess and deficient ADIT will be an important consideration in transmission rate filings in 2020 and beyond.

A Primer on ADIT & Excess ADIT

FERC jurisdictional electric transmission rates generally follow the “tax normalization” method, which means that transmission rates reflect the utility’s cost of both current and deferred income taxes. Accordingly, a utility’s accumulated deferred tax assets reflect tax dollars paid by the utility but not yet collected from customers while the utility’s accumulated deferred tax liabilities reflect tax dollars collected from customers but not yet paid by the utility. The timing difference between a utility’s payment of deferred income taxes and the recovery of such taxes from customers is reflected in the utility’s transmission rate base, where accumulated deferred tax assets are additions to rate base and accumulated deferred tax liabilities are subtractions from rate base.

On December 22, 2017, the President signed into law the TCJA and, among other things, reduced the federal corporate income tax rate from 35 percent to 21 percent, effective January 1, 2018. Under applicable accounting principles, ADIT must be accounted for by multiplying a taxable organization’s deferred taxable income, as evidenced by temporary differences in the organization’s book-tax basis, by the statutory tax rate at which the organization expects to pay income taxes in the future. Accordingly, the reduction in the federal corporate income tax rate, under the TCJA, caused taxable organizations to “write down” or reduce the value of their ADITs to reflect the reduced federal tax rate. For most taxable organizations, the reduction in ADIT was be reflected as a boost to reportable earnings. For regulated utilities, however, the reduced ADIT raised questions about whether customers should be refunded a portion of their deferred tax “prepayments,” which were collected at 35%

but now payable by the utility at 21%, and whether customers should reimburse their utility for the utility’s tax payments made at 35% but expected to be included in rates, under tax normalization, at 21%. Additional questions arose as to whether FERC action was needed to protect customers against losing rate base credit for excess ADIT, the portion of a utility’s ADIT written off to reflect the reduced tax rate under the TCJA. At that point, conversations about excess and deficient ADIT and tax gross-ups began echoing across the business offices of public utilities and down the halls of utility regulators.

KEY TAKEAWAYS FROM FERC’S FINAL RULE

Takeaway One: There Are Three New Requirements for Transmission Formula Rates

FERC’s Final Rule requires two new formula rate mechanisms and one new ADIT reporting worksheet to be included in each transmission formula rate.

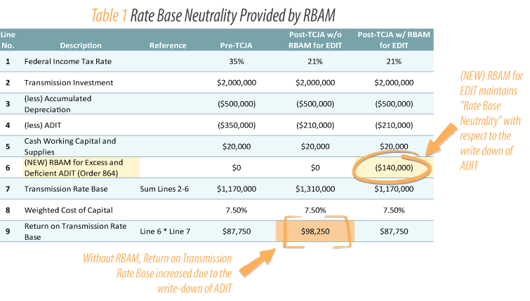

a. Rate Base Adjustment Mechanism

First, under the Final Rule, utilities with transmission formula rates must include a Rate Base Adjustment Mechanism (“RBAM”) in their formula rates, which is a mechanism by which utilities deduct any excess ADIT from or add any deficient ADIT to their rate bases. In other words, any change in rate base due to the revaluation of ADIT following a tax rate change must be offset by the inclusion in rate base of a credit for unamortized excess or deficient ADIT. As presented in Table 1, this new mechanism provides “rate base neutrality” with respect to the effects of income tax rate changes. Moreover, the Commission found that the RBAM was necessary to avoid violating the Commission’s policy on tax normalization.

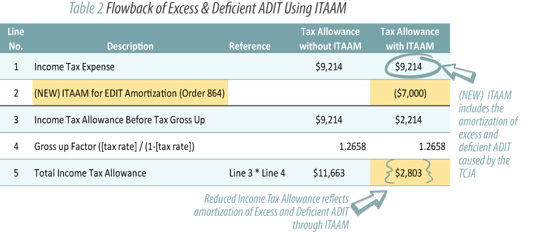

b. Tax Allowance Adjustment Mechanism

Second, utilities will be required to include an Income Tax Allowance Adjustment Mechanism (“ITAAM”) in their formula rates to decrease or increase the income tax components of their revenue requirement to reflect the amortization of excess or deficient ADIT, respectively. As presented in Table 2, the ITAAM will be the mechanism by which public utilities with transmission formula rates return excess ADIT to or recover deficient ADIT from ratepayers.

c. ADIT Worksheet

Finally, the Commission’s Final Rule requires each utility to include in its formula rate a workpaper that provides transparency into its quantification and amortization of excess and deficient ADIT. The new worksheet must include, at a minimum, information pertaining to the five ADIT considerations: (1) how any ADIT accounts were remeasured and the excess or deficient ADIT contained therein; (2) the accounting for any excess or deficient amounts in Accounts 182.3 (Other Regulatory Assets) and 254 (Other Regulatory Liabilities); (3) whether the excess or deficient ADIT is protected or unprotected; (4) the accounts to which the excess or deficient ADIT are amortized; and (5) the amortization period for returning or recovering the excess or deficient ADIT through rates.

Takeaway Two: The Impact of Excess and Deficient ADIT on Transmission “Stated” Rates Will be Addressed in Future Rate Cases

With respect to transmission “stated” rates (e.g., rates that are fixed and not formulaic), the Commission relaxed its initial proposed rule in the Notice of Proposed Rulemaking (“NOPR”). In its NOPR, the Commission proposed to require public utilities with transmission stated rates to (1) determine the excess and deficient income tax caused by the TCJA, and to (2) return or recover such excess or deficient amount from customers. However, the Commission changed course in its Final Rule and found that applicable Commission precedent and regulation for stated rates supported simply deferring the issue of excess and deficient ADIT until the utility’s next rate case.

Takeaway Three: The Conversation About Excess and Deficient ADIT Will Continue in 2020 and Beyond

Perhaps the most obvious takeaway from Order 864 is that the conversation about excess and deficient ADIT is not going away soon. In 2020, utilities with transmission formula rates are required to make compliance filings to demonstrate their

compliance with Order 864. Each compliance filing will allow interested parties the opportunity to comment on the utility’s proposed RBAM, ITAAM, and ADIT Worksheet. Importantly, Order 864 established that certain aspects of a utility’s ADIT rate treatment, such as the length of the unprotected excess and deficient ADIT amortization period and the design of the ITAAM, will be reviewed on a case by case basis.

Moreover, Order 864 teed up the consideration of excess and deficient ADIT as an important element in upcoming transmission stated rates. The Commission explained that the question of how to properly handle excess and deficient ADIT in the context of transmission stated rates raises complex questions that are more properly addressed in individual proceedings brought under sections 205 or 206 of the Federal Power Act (“FPA”) and where all interested parties could weigh in. The Commission’s rationale foreshadows the complexity of excess and deficient ADIT issues on the horizon and reminds us that ratepayers subject to transmission stated rates might start the conversation of how to treat excess and deficient ADIT sooner rather than later by filing a complaint under FPA section 206.

OVERALL IMPACT ON FERC JURISDICTIONAL ELECTRIC RATES

The impact of implementation of the Order 864 on transmission rates will vary greatly from utility to utility. The primary drivers will be the balance of the excess and deficient ADIT and the period used to amortize such balances into rates. In particular, the “unprotected” portion of a utility’s excess and deficient ADIT, as defined by regulations of the IRS, can be returned to customers over any reasonable period of time determined by the utility. In one case, the utility agreed to amortize the entire amount of unprotected excess and deficient ADIT over a one-year period resulting in a 20% decrease to transmission rates.

While a one-year amortization of unprotected excess and deficient ADIT may be unreasonable for many utilities due to cashflow considerations, that case demonstrates the material rate benefit realized when utilities employ a shorter amortization period. So far, most utilities have been proposing amortization periods in the range of one to ten years for the unprotected excess/deficient ADIT depending on the magnitude of the balances to be flowed back.

Importantly, Order 864 applies specifically to transmission formula rates, but the guidelines provided in the Final Rule may influence other FERC jurisdictional rates. For example, most of the concepts contemplated in Order 864 should apply to wholesale production and distribution formula rates, which are generally like transmission formula rates and contain cost-of service components to account for ADIT in rate base and the allowances associated with income taxes. Accordingly, wholesale customers will need to consider whether their rates fairly treat excess and deficient ADIT and whether additional steps are necessary to ensure that they reap the full benefits of the TCJA.

For more information or to comment on this article, please contact:

Chad Wilcox, Project Manager | CONTACT

Chad Wilcox, Project Manager | CONTACT

GDS Associates, Inc. – Orlando, FL

407-563-6464 or chad.wilcox@gdsassociates.com

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)