- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

FERC's ROE Method is Remanded: What's Next?

by GDS Associates, Inc | December 15, 2022 |

The Rundown

Court remand of the Federal Energy Regulatory Commission’s (“FERC”) controversial Return on Equity (“ROE”) methodology provides an opportunity to improve its approach, with the Capital Asset Pricing Model’s (“CAPM”) Market Return estimate being a clear candidate for reform.

FERC’s Market Return estimate, with its sole reliance on short-term analyst earnings growth rates as part of the calculation, is illogical and renders the estimate unreliable and arguably grossly inflated. Reform of the method is required.

Pending a Commission order addressing the remand, ratepayers can take advantage of the pause, seek to achieve savings now and not later, and also greatly influence the Commission’s view by putting forward a credible and justified position on ROE through challenging an existing ROE that forms part of their current wholesale rate or one that is newly requested by a utility.

FERC’s new controversial ROE methodology has been recently remanded by the D.C. Circuit Court of Appeals. In its August 2022 opinion, the court found that FERC’s rationale for its about-face on the use of the Risk Premium method to be arbitrary and capricious.1 In its 2019 order for the Midcontinent ISO ROE complaint, FERC at first forcefully rejected the method but then subsequently in its 2020 re-hearing order, FERC found that the method’s deficiencies to be less problematic and adopted the method alongside the Discounted Cash Flow (“DCF”) model and CAPM. The court found FERC’s explanation for its use of these other models, and the inputs therein, to be sufficient.

While the court focused on the inadequacies of the Commission’s position on the Risk Premium method, now that the orders are remanded, there is a clear opportunity for FERC to refine its broader approach to determining just and reasonable ROEs. One notable area that can be improved is the manner in which FERC calculates the Market Return and Market Risk Premium estimates as part of the CAPM and bring it more in line with other reasonable third-party estimates. This is expected to produce more moderate CAPM based ROE estimates and in turn will put downward pressure on new ROE requests by a utility or make it clear that certain utilities’ existing ROEs are excessive and warrant action by ratepayers to reduce the ROEs incorporated in their wholesale charges.

how does ferc calculate the market return and the market risk premium?

In its Opinion 569 series of decisions (now remanded) which established FERC’s new ROE approach, the Commission explained it will calculate the Market Return by applying a Discounted Cash Flow (“DCF”) model to a dataset comprised of the dividend-paying companies in the S&P 500 index. The DCF method requires the identification of the dividend yield for every company in the sample together with an estimated earnings per share growth rate projection.2 These two variables are added together to create a company by company Market Return estimate and these individual results are weighted by each company’s respective market capitalization value to arrive at an overall weighted Market Return estimate.

To estimate the growth rate component of the equation, the Commission decided to ONLY utilize a short-term growth rate that specially covers the next 3-5 year period and it did not include any longer term growth rate projection. The Market Risk Premium is estimated by deducting the Risk-Free Rate from the Market Return. FERC measures the Risk-Free Rate using the six-month average 30-year Treasury bond yield.

What's Wrong with the Commission's Approach?

The omission of a long-term growth rate projection is a fatal error and renders the resulting estimate unreliable and arguably grossly inflated. It is well- stablished that all company earnings growth rates are constrained in the long run by the rate of growth in the economy as a whole. It is for this very reason that many experts have expressed the need to include a long-term growth rate when applying the DCF method. Indeed, in addition to the use of the CAPM method in its broader framework, the Commission uses a separate DCF model, which is applied to a proxy group of electric utilities, and this model incorporates both short-term and long-term growth rates. It also runs counter to how established financial firms derive Market Return estimates with Bloomberg, for example, applying a model that converges analyst short-term forecasts to the long-term GDP growth rate over a period of 8-15 years.

Comparison to other market return/risk premium estimates

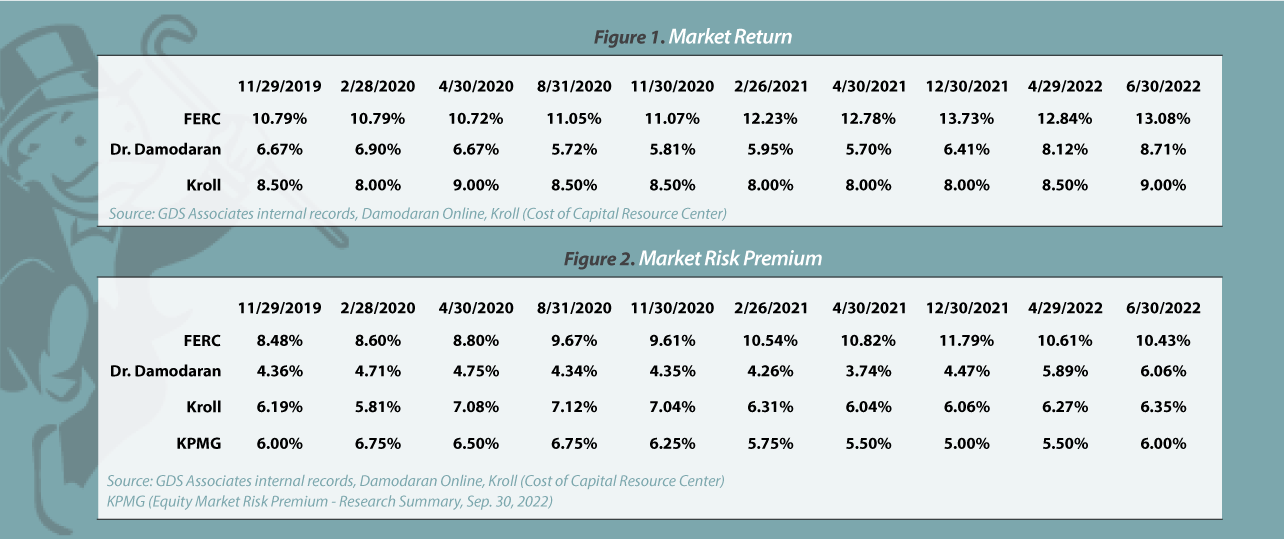

A straightforward approach to sense-check the (un)reasonableness of FERC’s Market Return and the subsequent Market Risk Premium component is to compare these estimates to other readily available third-party estimates. In the Exhibits below, we compare several different estimates over a series of specific intervals from November 2019 onwards, which was when FERC first made a determination regarding its preferred Market Return and Market Risk Premium methods. To measure the Market Risk Premium from these third-party estimates, we utilize FERC’s approach of using the six-month average 30-year Treasury bond yield for the Risk-Free Rate.

Figure 1 and Figure 2 clearly demonstrate that FERC’s estimates are significantly greater than the third-party estimates. It bears nothing that these third-party estimates of the Market Risk Premium are much more similar to the long-term historically measured market risk premium of 6% than the estimates produced when using the FERC method.

How Can FERC Improve the Market Return and Market Risk Premium Estimates?

At a minimum, FERC can incorporate a long-term GDP growth rate as part of its S&P 500 DCF model. Moreover, the short-term and long-term growth rates should be weighted in accordance with FERC’s long-standing policy until recently, of weighing the former at 2/3 and the latter at 1/3. This balance remains a conservatively high weight for the short-term rate.

The Commission should also consider the inclusion of a Market Risk Premium that is derived from historical data, which is an approach many financial firms (e.g. MorningStar) and federal agencies rely upon.

How Does This Improvement Impact CAPM Results?

The inclusion of a long-term GDS growth rate as part of the FERC calculation, as described above, would reduce a mid-year 2022 Market Return estimate from 13.08% to 11.20%. Correspondingly, the Market Risk Premium would decline from 10.43% to 8.55%. These revised values remain substantially greater than other third-party estimates, but such a revision provides an important step in the right direction. Further refinements to the estimation approach may be warranted.

Using this reduced Market Return estimate as part of the Commission CAPM model (and making no other changes) would lower the median CAPM from around 12.00% to 10.3% and, in turn, significantly push down the overall ROE that FERC would find just and reasonable.

What Avenues are Available to Ensure Just and Reasonable ROEs?

While we wait for FERC to respond to the court’s remand, the opportunity remains for ratepayers to pursue lower ROEs, through challenging an existing ROE that forms part of their current wholesale rate or one that is newly requested by a utility. It is highly recommended that ratepayers assess whether existing or newly proposed ROEs are excessive and to seek remedial action when necessary. Otherwise, ratepayers will be paying rates that are simply too high. Additionally, through participating in formal FERC proceedings, ratepayers can seek to directly influence the Commission’s new methodology by putting forward a credible and justified positions on ROE that

will have a long lasting impact.

GDS Associates has been helping ratepayers navigate the recent period of FERC ROE flux and has assisted with securing lower ROEs through complaint filings and subsequent settlement negotiations. These efforts have led to significant costs savings for ratepayers. The GDS Associates cost of capital team stands ready to advise and work with you to achieve just and reasonable ROEs.

For more information or to comment on

For more information or to comment on

this article, please contact:

Breandan Mac Mathuna, Principal

GDS Associates, Inc. - Marietta, GA

770.799.2391 or

breandan.macmathuna@gdsassociates.com

References

1 The court’s opinion does not prohibit the FERC from addressing the court’s concerns regarding its explanation for relying on the Risk Premium method and subsequently relying on the method.

2 This is used as a proxy for the growth rate of dividends.

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)