- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

The Electricity Use Flatline - GDS Associates, Inc -

by GDS Associates, Inc | July 18, 2017 | Newsletter - TransActions

Why American Households are Consuming Less Energy

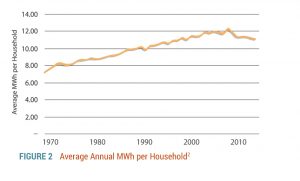

In the 80s and 90s, electricity usage in the United States grew at roughly 2.5% per year. Seemingly, as if on cue with the new millennium, a shift occurred in the early 2000s. From 2000 to 2007, total electricity usage grew by just under 1.5% per year. Since the Great Recession, total electricity consumption growth has completely stalled out. In fact, electricity sales in the U.S. have fallen five out of the past eight years as seen in Figure 1.

American energy usage is drastically different than it was twenty years ago, or so it seems. So the obvious questions are: what is driving evolving consumption patterns? What is expected to change in the future? This article provides some of the major reasons industry experts give for the consumption stall-out for the residential sector. A follow-up article will explore the factors behind changes in commercial and industrial consumption patterns.

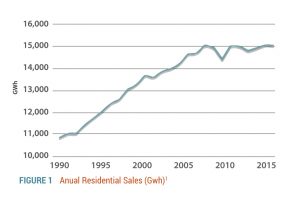

Technological advances, changes in household structure, and increases in consumer awareness are only a few of the factors that have changed the way we use electricity in the home. Projections of total electricity sales to the residential class continue to increase due solely to population growth. As shown in Figure 2, electricity usage per household has decreased or remained flat each year since 2010. There are four main factors suppressing residential household consumption growth: economics, energy requirements of homes, population migration patterns, and solar generation.

What is Driving Evolving Consumption Patterns?

Economics

The housing market crash and succeeding recession of 2008 impacted the electricity consumption behavior of many consumers. Members of the Baby Boomers Generation and Generation X downsized their homes and Millennials continued to rent smaller homes in more urban areas instead of following the typical pattern of suburbanization.

Many Americans lost jobs and most Americans experienced a decrease in disposable income. Tighter household budgets resulted in greater energy conservation efforts by the typical residential consumer. There is no doubt that the Great Recession had a significant impact on the leveling and reductions in household electricity consumption. However, while much of the economy has recovered to pre-recession levels, average electricity usage per household has not returned to pre-recession levels. So, factors other than the economy have also contributed to zero growth in household consumption since 2008.

Energy Requirement of Homes

This brings us to energy efficiency and conservation: both have contributed to reductions in residential electricity consumption through the success in utility-administered demand side management (DSM) programs and in savings attributable to general increases in efficiencies throughout the home. Savings from DSM programs have grown, with nearly 12 million MWh in savings from utility-administered programs in 2015 alone3. In addition to formal efficiency programs, replacement of appliances as they become outdated also provides large reductions in a home’s energy requirements. Government efficiency standards ramped up in the 1990s and many appliances, such as refrigerators, have longer lifespans. Building codes and standards have also evolved to require construction that results in a more energy efficient home. Newly constructed homes lose less heat in the winter and let in less heat in the summer. With improved minimum SEER standards, HVAC systems are more efficient than ever and require less work to cool a home. Consumers in new homes, or with updated appliances, save electricity, and money, automatically.

New homes often include LED light bulbs, which also provide savings in electricity. In addition to LED installations in new homes, residential consumers have also begun replacing existing fixtures with LED bulbs. By installing energy efficient appliances as their current appliances reach the end of their lives, consumers can conserve electricity and save money, without any behavioral changes in consumption. Along with greater energy savings being achieved through DSM appliance, fixture, and bulb replacement programs, the emphasis on education about efficiency and conservation has also created a society that is more aware of electricity conservation than generations past.

Population Migration Patterns

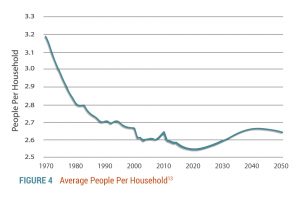

The years following the recession saw the first drop in square footage of new homes since the early 1980s. Millennials, just beginning to enter adulthood, continued to rent in urban areas instead of buying in suburban or rural areas. This led to a brief post-recession period where it looked like America was headed for re-urbanization. From 2008-2012, population growth in urban areas outpaced suburban area growth for the first time since the beginning of the suburbanization movement in the 1920s. Baby boomers, now becoming empty nesters, downsized in large numbers and moved to cities. Young professionals delayed moving to the suburbs and starting families. Furthermore, the average number of people per household has been gradually declining since the 1970s, per Census bureau data. A declining number of people in the home typically reduces electricity consumption for water heating, laundry, and dishes. These factors worked together to shift average home sizes downward for a few years after the recession.

Migration to warmer, southern parts of the country (deemed the “Sunbelt”) has increased over the past few decades. Americans, particularly retiring baby boomers, are leaving colder, land-locked cities and heading for warmer weather. In 2015, population growth in the South and West grew at 1.2%, while the Northeast and Midwest grew at only 0.2%6. A greater population in the South and West grew at 1.2% while the Northeast and Midwest grew at only 0.2%. A greater population in the South and West reduces the need for space heating. While such population shifts will increase the need for already efficient air conditioning, it will also create more opportunity for consumers to consider solar generation on their homes, where southern latitudes enjoy a sunshine advantage.

Along with greater energy savings being achieved through DSM appliance, fixture, and bulb replacement programs, the emphasis on education about efficiency and conservation has also created a society that is more aware of electricity conservation than generations past.

Solar Generation

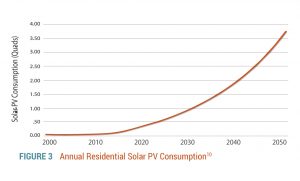

Distributed generation, specifically solar photovoltaic (PV) technology, has grown dramatically in the past five years. Residential solar panel installations were much higher than any year before, mainly due to the extension of government tax credits, and these installations reduce the amount of energy that residential customers buy from electric utilities. In 2016, community solar projects quadrupled7. Installation and maintenance costs of solar PV technology continue to drop, further incentivizing customers to join the green energy movement.

There are therefore several factors that have worked together to keep residential household electricity consumption flat for the past 10 years. The economic recession and the slow recovery shifted budgetary priorities. Housing trends faced at least a momentary shift as average home sizes declined for a few years. Other generational migration patterns and choices impacted home sizes and the average number of people per household. Probably most importantly, continued gains in appliance efficiencies, the emphasis on DSM, and voluntary conservation have had significant impacts on the structure of the home and the appliances within. And, as solar has become more cost effective and vigorously supported by government programs, growth has skyrocketed, offsetting consumption from the grid. Next, we turn to a brief discussion of when this era of no-growth in household consumption is expected to change.

What is Expected to Change in the Future?

Future changes are expected to have both positive and negative effects on household electricity consumption. Let’s start with the negative (from a household consumption perspective): solar PV capacity is expected to grow exponentially for some years yet. Solar capacity is expected to be approximately 12 times the current capacity by 2050 as shown in Figure 3, even as solar generating capacity growth is expected to slow as large markets, such as California, reach heavy saturation of early adopters. Continued capacity increases, especially when coupled with expanding battery storage technology, reduce consumer electricity consumption. Tesla’s Elon Musk believes that one-third of future electricity generation will be from consumer-owned renewable energy9. While this observation is an optimistic one, rapidly expanding residential solar and community solar projects will lead to reductions in consumers’ energy requirements from the grid.

On the positive side: all technology, not just solar PV, continues to grow. Electric vehicles are expected to make up 35% of all vehicle sales by 2040.

Growth in electric vehicle and consumer electronic devices increases the electricity usage per home. As new appliances continue to replace outdated ones and appliance efficiency reaches near maximum, the negative appliance replacement effect on electricity usage will decline. In future years, the re-urbanization effect seen amongst Millennials will diminish. Woods & Poole Economics expects the number of people per household at the national level to begin an increasing trend around 2020 before decreasing again in 2050, as shown in Figure 4.

The decline and then growth pattern in people per household is likely an effect of the large Millennial generation delaying having children. As the economy continues to return to health and Millennials enter their thirties, the status-quo suburbanization effect is expected to return. Millennials will purchase their own large, suburban homes, start families, and increase their electricity usage accordingly. Finally, it is expected that the number of small consumer electronics (phones and chargers, video games, televisions, other technology not yet invented) will continue to increase over time, eventually helping to offset some of those factors currently depressing household consumption growth.

Conclusion

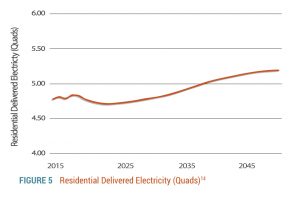

Changes in forecasted residential consumption, which is shown in Figure 5, can be attributed to behavioral and technological adaptations as well as evolving industry standards. The EIA expects electricity usage per household to decline by nearly 18 percent from 2017 to 2050, and about half of that decline is expected to occur by 2025. In the meantime, keep an eye out for the upcoming article discussing drivers of decreasing electricity intensity in the commercial and industrial sectors.

For more information or to comment on this article, please contact:

John Hutts, Principal | CONTACT

John Hutts, Principal | CONTACT

GDS Associates, Inc. – Marietta, GA

770.425.8100

DOWNLOAD PDF

Also in this issue: What’s Trending

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)