- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Distributed Generation: Making a Deal Between Opportunities and Challenges

by GDS Associates, Inc | December 14, 2015 | Newsletter - TransActions

Distributed generation (“DG”) is going to be a major influence in the future of the electric industry in the United States. The blend of existing opportunities and challenges has created an environment for electric utilities to consider integrating DG technologies into their business models. The Utility Dive’s 2015 State of the Electricity Utility survey of 433 U.S. electric utility executives indicates that DG will be the biggest driver of disruptive growth in the industry over the next five years. Utilities recognize the vast opportunity distributed energy resources can provide as well as the unique challenges they present. Some companies have been exploring DG technologies and General Electric has created a new DG business by combining parts of its transportation, aviation and engines divisions to meet what GE calls, “a $100 billion opportunity”.

Distributed generation (“DG”) is going to be a major influence in the future of the electric industry in the United States. The blend of existing opportunities and challenges has created an environment for electric utilities to consider integrating DG technologies into their business models. The Utility Dive’s 2015 State of the Electricity Utility survey of 433 U.S. electric utility executives indicates that DG will be the biggest driver of disruptive growth in the industry over the next five years. Utilities recognize the vast opportunity distributed energy resources can provide as well as the unique challenges they present. Some companies have been exploring DG technologies and General Electric has created a new DG business by combining parts of its transportation, aviation and engines divisions to meet what GE calls, “a $100 billion opportunity”.

Background

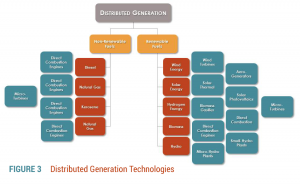

For decades, utilities and retail customers have used DG to generate electricity at the point of consumption using technologies like reciprocating diesel engines, natural gas turbines, fuel cells, solar panels and small wind turbines (see Figure 3).

Historically, natural gas and diesel technologies were used for commercial emergency and standby generation, or as a means of overcoming geographical limitations. utilities have installed these types of generators at substations for peak shaving as well as voltage support and reliability purposes. Interest in DG has been on the rise since the enactment of the Public Utility Regulatory Policies Act (PURPA) of 1978. PURPA was created in response to the 1970s’ energy crisis which encouraged greater utilization generation from non-utility power producers and increased research in hydroelectric, wind, and solar generation technologies. This research led to a drastic reduction in manufacturing costs of solar panels, a nearly 70% cost reduction from 1980-1995, as well as leading to significant reductions in the production cost of wind turbines. With the passage of the Energy Policy Act of 1992, the wholesale electric markets were opened up to competition which further boosted interest in DG technologies.

Historically, natural gas and diesel technologies were used for commercial emergency and standby generation, or as a means of overcoming geographical limitations. utilities have installed these types of generators at substations for peak shaving as well as voltage support and reliability purposes. Interest in DG has been on the rise since the enactment of the Public Utility Regulatory Policies Act (PURPA) of 1978. PURPA was created in response to the 1970s’ energy crisis which encouraged greater utilization generation from non-utility power producers and increased research in hydroelectric, wind, and solar generation technologies. This research led to a drastic reduction in manufacturing costs of solar panels, a nearly 70% cost reduction from 1980-1995, as well as leading to significant reductions in the production cost of wind turbines. With the passage of the Energy Policy Act of 1992, the wholesale electric markets were opened up to competition which further boosted interest in DG technologies.

Increased DG Utilization

The continuous improvements in DG technology means that today, these generators are less expensive, more efficient, and more widely available than ever before. DG typically requires less capital investment (on an installed $/kW basis) than centralized generation and provides utilities with greater flexibility in siting generation resources. DG benefits include: reduction in transmission investment, managing constraints on transmission and distribution systems, mitigating potential power outages, and hedging against extreme variations in energy prices. However, four of the main challenges and opportunities around DG are accessible solar generation, energy storage, new regulatory/business models, and customer engagement.

Accessible Solar Generation

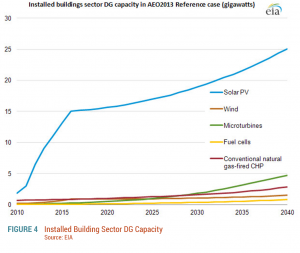

Although solar power still comprises less than 0.5% of the total electric energy requirements in the U.S., there has been exponential growth in solar installations over the past four years. In 2013, total solar installations reached 4.7 GW. According to the Solar Energy Industry Association (SEIA), that level of growth made solar power the second-largest source of new electric capacity in the United States. The number of installations grew 30% in 2014 and this trend of rapid solar installations is expected to continue over the next 25 years as illustrated in Figure 4.

While residential installations have grown nearly 50% annually since 2012, the vast majority of the installations, propelling the solar industry over the past four years, have been utility scale projects. Residential solar demand has increased due to the reduction in production costs and creative financing options from solar developers, such as purchase power agreements (PPA), lease options, and solar power loans. Perhaps the most interesting trend on the commercial side, and one to watch in the coming years, is solar developers and retailers beginning to offer energy storage as an additional tool to reduce demand charges and maximize the accessibility of solar benefits.

Energy Storage

Electric utilities are interested in energy storage on a large scale. Recently, Southern California Edison executed an agreement with Oncor Electric to provide 261 MW of energy storage. This agreement was followed by the announcement by a Texas utility seeking authorization to add 5 GWs of storage to integrate renewable technologies into the transmission grid. Battery technology is improving and the prices are expected to continue to fall significantly as manufacturing capabilities expand the potential of energy storage. Utilities agree in their response to the 2015 Utility Dive survey that energy storage is the number one technology that can potentially transform the utility business over the next 10 years.

New Regulatory and Business Models

Multiple investment banks such as Morgan Stanley are predicting that high penetration rates of solar powered DG combined with improvements in energy storage could be disruptive for electric utilities. For DG customers in 43 states, the potential exists for customers to completely eliminate their power bills. This possibility now exists, in large part, because of customer eligibility for Federal Government’s Investment Tax Credit (ITC) as well as expanded net metering regulations. While the ITC is set to expire at the end of 2016 (under current legislation), net metering continues to represent a challenge and an opportunity for electric utilities.

Net metering is the mechanism that allows retail customers with DG to buy and sell power through the use of bi-directional metering. These customers use their DG output to offset the power purchased from their electric utilities. With the two way street of power flowing to and from customers, there are new economic and physical challenges that must be addressed through regulation and utility business models. As mentioned earlier, electric utilities in 43 states must provide net metering. Each state has its own set of rules and operating requirements, but there is one common issue: should the consumption and production of electricity be bought and sold separately or should customers be charged based on their net consumption from the utility? States are determining how to revise net metering regulations to ensure that the impact of cost shifts between electric utilities and customers is minimized. From the electric utility’s perspective, one of the most important considerations in the net metering debate is to ensure recovery of (sunk) fixed costs – from existing generation resources as well as transmission and distribution assets. One example of this concern is occurring within the state of Hawaii. More than 10% of Hawaii Electric’s retail customers have installed solar which has resulted in the significant loss of retail energy sales and some operational and financial challenges for the utilities. This potential for retail customers to move away from centralized power consumption has prompted many electric utilities to push for new regulation and the creation of new business models. Hopefully, the answer to these problems can be solved with cost-based retail rate design and updated regulations that balance the interests of consumers with and without DG. New regulations, for example, could allow utilities to utilize decoupled ratemaking where energy sales, energy savings, and demand costs are recovered more appropriately in rates.

Net metering is the mechanism that allows retail customers with DG to buy and sell power through the use of bi-directional metering. These customers use their DG output to offset the power purchased from their electric utilities. With the two way street of power flowing to and from customers, there are new economic and physical challenges that must be addressed through regulation and utility business models. As mentioned earlier, electric utilities in 43 states must provide net metering. Each state has its own set of rules and operating requirements, but there is one common issue: should the consumption and production of electricity be bought and sold separately or should customers be charged based on their net consumption from the utility? States are determining how to revise net metering regulations to ensure that the impact of cost shifts between electric utilities and customers is minimized. From the electric utility’s perspective, one of the most important considerations in the net metering debate is to ensure recovery of (sunk) fixed costs – from existing generation resources as well as transmission and distribution assets. One example of this concern is occurring within the state of Hawaii. More than 10% of Hawaii Electric’s retail customers have installed solar which has resulted in the significant loss of retail energy sales and some operational and financial challenges for the utilities. This potential for retail customers to move away from centralized power consumption has prompted many electric utilities to push for new regulation and the creation of new business models. Hopefully, the answer to these problems can be solved with cost-based retail rate design and updated regulations that balance the interests of consumers with and without DG. New regulations, for example, could allow utilities to utilize decoupled ratemaking where energy sales, energy savings, and demand costs are recovered more appropriately in rates.

Customer Engagement

Regardless of the business strategy, electric utilities will have to understand and anticipate the customer’s needs. The days of the customers only engaging the utility because of outages and billing questions are coming to an end. Utilities have a great opportunity to use DG as a tool to create new customer experiences with higher frequency communications. The significance of this opportunity is illustrated in the fact that 76% of respondents to the Utility Dive survey indicate that utilities have increased their investment in customer engagement. By increasing the level of customer engagements, electric utilities can create opportunities to provide new services. With respect to DG, utilities can leverage their expertise as a smart integrator of DG technologies to assist the customer with product evaluations and selection. Electric utilities can also expand energy efficiency and renewable energy resources and infrastructure to help expand DG options for retail customers. That may require certain investments in the distribution system as well as revising net metering policies and utilities should establish policies that improve their ability to invest and recover those related costs.

Conclusion

Distributed generation will have a major impact on the future of the electric industry in the United States. Three key actions utilities need to take in order to make the most out of the DG opportunity are:

- Gain regulatory support to recover DG investment costs in retail rates. Work with regulators to ensure that net metering does not result in cross-subsidy and that customers pay their share of the transmission and distribution network costs.

- Develop strategies to assess the technical and economic potential of DG resources whether they are owned by the utility, the customers or a third party in their service territory. To do so, utilities must understand customer load profiles and identify locations where a particular strategy provides the greatest benefits to the utility system.

- Utilities should evaluate the business opportunities of being involved in the development, financing, implementation, construction, operation and maintenance of DG solutions. There may be DG applications on a “community” basis as well as for individual retail customers.

For more information or to comment on this article, contact:

Emmanuel Miller, Engineer | CONTACT

Emmanuel Miller, Engineer | CONTACT

GDS Associates, Inc. – Marietta, GA

770.425.8100

DOWNLOAD PDF

Also in this issue: Survivor: The Natural Gas Dilemma Edition

GET OUR NEWSLETTER

RECENT POSTS

- Protect the Grid: Act on Facility Ratings Today

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

- January 2026 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (18)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)