- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

EV TIPS

by GDS Associates, Inc | December 15, 2020 | News , Energy Use & Efficiency , Newsletter - TransActions

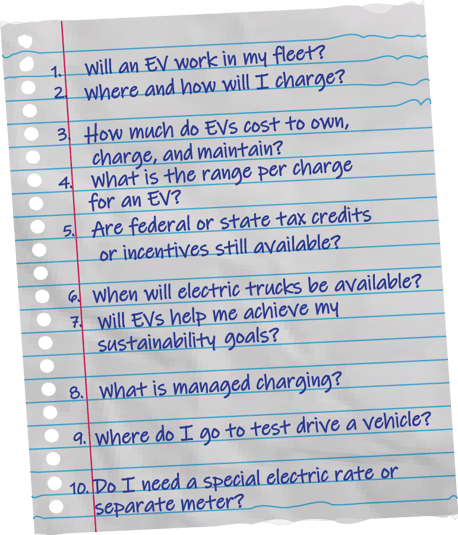

If you have asked yourself any of these or similar questions, you are not alone. Numerous utilities, municipalities, and states are exploring and moving forward with electric vehicle system investments and incentives, but many are seeking to make sense of this complex landscape. It’s important to first develop a framework for strategizing and planning for electric vehicles. GDS has developed an approach for creating a comprehensive plan called EV TIPS. EV TIPS is an acronym for Electric Vehicle Technology, Infrastructure, Policy and Strategy. These four elements combine to optimize how a utility may take action to respond to EV growth and opportunities. It’s also important to recognize that these four elements drive a need for coordination and collaboration with many difference stakeholders, organizations, and even across utility departments. This framework helps to identify and structure many of the considerations to develop and implement an electric vehicle program.

If you have asked yourself any of these or similar questions, you are not alone. Numerous utilities, municipalities, and states are exploring and moving forward with electric vehicle system investments and incentives, but many are seeking to make sense of this complex landscape. It’s important to first develop a framework for strategizing and planning for electric vehicles. GDS has developed an approach for creating a comprehensive plan called EV TIPS. EV TIPS is an acronym for Electric Vehicle Technology, Infrastructure, Policy and Strategy. These four elements combine to optimize how a utility may take action to respond to EV growth and opportunities. It’s also important to recognize that these four elements drive a need for coordination and collaboration with many difference stakeholders, organizations, and even across utility departments. This framework helps to identify and structure many of the considerations to develop and implement an electric vehicle program.

TECHNOLOGY – build it and they will come. Over $80 billion in EV-focused investment has been announced by automakers, battery manufacturers and suppliers in the US. This represents  over 50 new models – including trucks such as the Ford F-150 and the Tesla Cybertruck. Did you see the recent announcement of the GMC All-Electric Hummer? In 2020, approximately 60 different electric vehicle models are available. There are two basic types of electric vehicles (EVs). Battery Electric Vehicles (BEVs) are powered exclusively from the on-board battery – vehicles include the Chevrolet Bolt, Audi e-tron, Kia Soul, Nissan Leaf, Tesla models, and Volkswagen e-Golf among others. Plug-In Hybrid Electric Vehicles (PHEVs) use both an electric motor and an internal combustion engine – vehicles include the Chevrolet Volt, Ford Fusion Energi, and Subaru Crosstrek Hybrid among others. For more information on the various types and models of EVs, check out the EV Showroom on the Go ElectricDrive website or the Find Electric Vehicle Models on the Energy.Gov website.

over 50 new models – including trucks such as the Ford F-150 and the Tesla Cybertruck. Did you see the recent announcement of the GMC All-Electric Hummer? In 2020, approximately 60 different electric vehicle models are available. There are two basic types of electric vehicles (EVs). Battery Electric Vehicles (BEVs) are powered exclusively from the on-board battery – vehicles include the Chevrolet Bolt, Audi e-tron, Kia Soul, Nissan Leaf, Tesla models, and Volkswagen e-Golf among others. Plug-In Hybrid Electric Vehicles (PHEVs) use both an electric motor and an internal combustion engine – vehicles include the Chevrolet Volt, Ford Fusion Energi, and Subaru Crosstrek Hybrid among others. For more information on the various types and models of EVs, check out the EV Showroom on the Go ElectricDrive website or the Find Electric Vehicle Models on the Energy.Gov website.

The new electric vehicle options are not limited to passenger vehicles and light duty trucks – there is increasing investment and research in medium and heavy-duty vehicles and equipment. These applications include transit and shuttle buses, school buses, cranes, forklifts, conveyors, refrigerator trucks, and commercial lawn mowers among others. Tesla was in the news recently with an announcement that the Semi, an all-electric Class 8 truck with a 500-mile range, would go into volume production in 2021. An increasing number of utilities, municipalities and corporations are including EVs in their overall fleet. With enhanced battery technology, the average distance per charge is increasing and is reliable for most personal and many business daily driving patterns. According to the U.S. Department of Transportation’s Federal Highway Administration, 80 miles of range is sufficient for 90% of household vehicle trips. Most EVs have a range of approximately 80 – 100 miles to 250 miles and higher. The fundamental technology and cost improvements are closing the price gap between EVs and internal combustion engine vehicles, with parity expected by 2025.

Based on the currently available EVs, plus the additional models that are coming in the next few years – an electric vehicle has the potential to be an attractive alternative to conventional fossil- fueled vehicles for many fleet applications and personal driving needs. Certainly, the pandemic is having an enormous impact across our economy – including the automotive market, transportation needs and commuting habits, among other areas. While overall vehicle sales projections are down, the Energy Information Administration (EIA) projects annual increases in electric vehicle sales reaching nearly one million electric vehicles sold annually by 2030 in the United States. In addition, the 2020 BloombergNEF Electric Vehicle Outlook Report projects that while the current electric share of total vehicle sales is relatively small, it is rising fast and by 2040, over half of all passenger vehicles sold will be electric globally and in the U.S. Given the large but somewhat uncertain scale of growth, careful planning and analysis is important to ensure prudent investments in EV technology and infrastructure.

fueled vehicles for many fleet applications and personal driving needs. Certainly, the pandemic is having an enormous impact across our economy – including the automotive market, transportation needs and commuting habits, among other areas. While overall vehicle sales projections are down, the Energy Information Administration (EIA) projects annual increases in electric vehicle sales reaching nearly one million electric vehicles sold annually by 2030 in the United States. In addition, the 2020 BloombergNEF Electric Vehicle Outlook Report projects that while the current electric share of total vehicle sales is relatively small, it is rising fast and by 2040, over half of all passenger vehicles sold will be electric globally and in the U.S. Given the large but somewhat uncertain scale of growth, careful planning and analysis is important to ensure prudent investments in EV technology and infrastructure.

INFRASTRUCTURE – where to charge and how do EVs impact the electric grid. Current studies show that over 80% of charging occurs at home, but charging infrastructure is expanding at workplaces, shopping centers, hotels and other commercial establishments. In addition, the VW Settlement funds are supporting installation of interstate and corridor charging, and many states and utilities are investing in charging infrastructure. There are three major categories of chargers, also called electric vehicle supply equipment (EVSE), based on the amount of power the charger provides to the battery. Level 1 (120-volt) is charging with a standard wall outlet in a garage and may take up to 24 hours to charge a vehicle. Level 2 (240-volt) requires charger installation for home and business use and is able to charge a vehicle in about 10 hours. Finally, DC Fast Chargers (480-volt) require more expensive and powerful charger installations and are typically for public charging stations. DC Fast Chargers are able to charge a vehicle in approximately one hour. Charging  times depend the on the type of EVSE, type of battery, level of discharge, and capacity. The type of charger needed will depend on the application and usage profile. This increase in charging infrastructure is great news for grid owners and convenient for EV users – as long as the load impact occurs off-peak and doesn’t contribute to the need for electric grid improvements. It is critical to understand potential peak demand, load shape and cost of service of an electric vehicle deployment to successfully integrate it on the electric system without unintended negative consequences. That is where managed or smart charging and thoughtful electric vehicle rate design come in to play. Managed charging has the ability to provide benefits such as transmission and distribution grid services including congestion and stress relief, capacity upgrade deferral, manage load across fleet applications and resiliency. In addition, rate structures that encourage off-peak charging may provide cost savings to both the EV driver and the utility.

times depend the on the type of EVSE, type of battery, level of discharge, and capacity. The type of charger needed will depend on the application and usage profile. This increase in charging infrastructure is great news for grid owners and convenient for EV users – as long as the load impact occurs off-peak and doesn’t contribute to the need for electric grid improvements. It is critical to understand potential peak demand, load shape and cost of service of an electric vehicle deployment to successfully integrate it on the electric system without unintended negative consequences. That is where managed or smart charging and thoughtful electric vehicle rate design come in to play. Managed charging has the ability to provide benefits such as transmission and distribution grid services including congestion and stress relief, capacity upgrade deferral, manage load across fleet applications and resiliency. In addition, rate structures that encourage off-peak charging may provide cost savings to both the EV driver and the utility.

POLICY – federal, state and local policies have an enormous impact on the rate of EV adoption or in how to optimize EV programs or rates. As you may have seen, California Governor Newsom issued an Executive Order to ban the sale of new internal combustion engines (ICE) passenger vehicles beginning in 2035. Federal and state tax credits and incentives (or penalties) also influence the EV market. At the local level, municipal and utility programs (such as EV charging  rates and rebates) play a key role in creating an environment that supports EV adoption by citizens and the business community. According to Atlas EV Hub, there is a significant level of activity at the state level regarding EV related legislation – there are 37 states considering issues such as building and parking requirements, charging standards or incentives, vehicles fees or incentives, public fleet requirements, vehicles to grid integration and others. The utilities have also been very active with EV related filings. There have been over 100 dockets filed by nearly 50 utilities in 34 states on topics such as EVSE ownership, EV rates, consumer education, evaluation and administration and EV incentives. To date, over $2 billion has been approved for utility investment including over 4,000 DC Fast Charging Stations and nearly 150,000 Level 2 Charging Stations. As utilities and municipalities develop programs and strategies, it’s important to consider federal, state and local policies or incentives. For example, if a state sponsored rebate or incentive program is not available, it may require greater local support to drive sales. Grants, public/private partnerships, tax incentives or credits, loan programs, rate design and regulatory constructs, and legislative actions all have potential financial implications for an EV deployment strategy.

rates and rebates) play a key role in creating an environment that supports EV adoption by citizens and the business community. According to Atlas EV Hub, there is a significant level of activity at the state level regarding EV related legislation – there are 37 states considering issues such as building and parking requirements, charging standards or incentives, vehicles fees or incentives, public fleet requirements, vehicles to grid integration and others. The utilities have also been very active with EV related filings. There have been over 100 dockets filed by nearly 50 utilities in 34 states on topics such as EVSE ownership, EV rates, consumer education, evaluation and administration and EV incentives. To date, over $2 billion has been approved for utility investment including over 4,000 DC Fast Charging Stations and nearly 150,000 Level 2 Charging Stations. As utilities and municipalities develop programs and strategies, it’s important to consider federal, state and local policies or incentives. For example, if a state sponsored rebate or incentive program is not available, it may require greater local support to drive sales. Grants, public/private partnerships, tax incentives or credits, loan programs, rate design and regulatory constructs, and legislative actions all have potential financial implications for an EV deployment strategy.

STRATEGY – there are so many options, so how will your organization position itself – what do you want your role to be. A proactive market maker, a fast follower or take a watch and wait approach? From a utility perspective, most provide some basic information on their website, have one of two EVs in their fleet, and have workplace charging available at the utility facility for company and/or employee use. A more pro-active approach may include a comprehensive plan including special EV rates, residential and business incentives  for charger equipment and/or vehicles, public use charging, managed charging or vehicle-to-grid pilots, dealer partnerships, customer engagement and more. Customer engagement may include ride and drive events (likely a virtual event in our current environment), workshops, EV club memberships, loaner programs and more. A comprehensive education and outreach program is the foundational element to increase driver awareness and to build momentum toward wide-scale EV adoption. Electrification of transportation will bring many benefits including cleaner air, new jobs and investment, community development, lower lifecycle costs and new mobility services. New stakeholder collaboration between automakers, utilities, communities, businesses and governments is needed to achieve the full potential of the many benefits available through electrification.

for charger equipment and/or vehicles, public use charging, managed charging or vehicle-to-grid pilots, dealer partnerships, customer engagement and more. Customer engagement may include ride and drive events (likely a virtual event in our current environment), workshops, EV club memberships, loaner programs and more. A comprehensive education and outreach program is the foundational element to increase driver awareness and to build momentum toward wide-scale EV adoption. Electrification of transportation will bring many benefits including cleaner air, new jobs and investment, community development, lower lifecycle costs and new mobility services. New stakeholder collaboration between automakers, utilities, communities, businesses and governments is needed to achieve the full potential of the many benefits available through electrification.

This is a very exciting time in the energy and transportation industries that creates many new opportunities and some new challenges as well. Electric utilities have to navigate the complexities and challenges associated with building an EV program for both internal and external applications. This includes fleet electrification strategies and analysis, load impacts and forecasting, regulatory and rate design considerations and stakeholder engagement and outreach. No matter where you are on the EV journey – whether you are just beginning to consider a program or have deployed vehicles and managed charging infrastructure, it is critical to stay abreast of industry trends, policy changes and potential economic and system impacts. GDS is launching a webinar series in February 2021 to take a deeper dive into each of these topics. In the meantime, if you’d like to explore this concept in more detail – we are happy to talk with you.

For more information or to comment on this article, please contact:

Angela Strickland, Managing Director | CONTACT

Angela Strickland, Managing Director | CONTACT

GDS Associates, Inc. – Marietta, GA

770-799-2422 or angela.strickland@gdsassociates.com

GET OUR NEWSLETTER

RECENT POSTS

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

- Building a Cyber-Aware Workforce in the Utility Sector

- Cyber Resiliency in the Utility Sector: Lessons from the Field

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- December 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (16)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)