- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Infrastructure Investment & Jobs Act: $80+ Billion Utility Benefits

by GDS Associates, Inc | October 7, 2021 | News , Energy Supply , Newsletter - TransActions , Transmission , Power Supply

Recently, the United States Congress has been drafting the

Recently, the United States Congress has been drafting the

Infrastructure Investment and Jobs Act (H.R. 3684) and

depending on the final version of the bill, there will be

potential impacts and benefits for electric utilities. The Act

contains over $80 billion in funding for energy programs

that directly or indirectly will benefit the utility industry,

the majority of which is to be expended between 2022 and

2026. The bill contains substantial funding for various

portions of the electric utility industry to support transforming the energy sector towards a net-zero carbon future, including:

- Grid Infrastructure and Resiliency

- Clean Energy Supply Chains

- Fuels & Technology Infrastructure

- Energy Efficiency

- Nuclear Energy

- Hydropower

- Energy Storage

Also of interest is the legislation’s provisions for electric

vehicle charging infrastructure, public transportation, and

clean school bus programs.

STATUS

With bipartisan support, the US Senate passed the $1 trillion infrastructure bill on August 10th, known as the “Infrastructure

Investment and Jobs Act” (Act). The legislation is now in the House of Representatives where it is expected to be passed by September 27th. It’s too early to determine what the final bill will be, but here is a general summary of items in the current draft legislation that are related to the electric industry.

SMALL UTILITY PROGRAMS

The Act recognizes the importance of supporting smaller electric utilities which can struggle with funding large infrastructure projects. The Act allocates $1.0 billion to rural or remote areas, defined as having a population of less than 10,000 inhabitants, for the funding of cost-effectiveness of energy generation, transmission or distribution systems siting/upgrades, greenhouse gas emission reduction, electric generation modernization, microgrid development, and energy efficiency. The legislation allocates 30% of the transmission infrastructure

funding to utilities that have less than 4,000,000 MWh in annual sales. There is also $250 million allocated to small utilities for cyber security program funding.

TRANSMISSION

The legislation includes significant transmission policy changes and funding, targeting the problems revealed in litigation of transmission siting that has occurred over the last several years. The bill attempts to fix the federal backstop authority in siting interstate transmission, allowing the federal government to override state-level permitting and establish designate transmission corridors based on current and projected transmission congestion. The nation’s aging transmission grid will need large investments if the US is going to achieve a net-zero carbon future by 2050. The Act includes $10.0 billion for improvements in transmission systems to reduce outages and improve resiliency. There is $1.0 billion targeted to rural and remote areas for transmission and distribution system improvement, including micro grids, increasing energy efficiency, and reducing greenhouse gas emissions. The Act includes $2.5 billion to facilitate the construction of transmission lines and related facilities. The Act also includes $3.0 billion of funding for technologies which enhance electric grid flexibility.

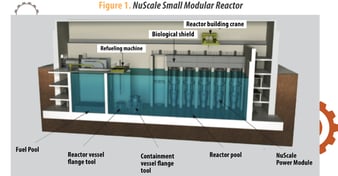

NUCLEAR POWER

Nuclear power is a zero-carbon source of electric production

and will be a key component of net-zero carbon power generation portfolios. Cheap natural gas generation has placed market pressures on nuclear plants which has led to nuclear plant closures over the last several years.  The closure of nuclear

The closure of nuclear

plants and replacement with natural gas generation has caused an increase in greenhouse gas emissions. In an effort to stem the closure of nuclear plants, the Act includes a $6.0 billion Nuclear Credit Program to prevent future closure of nuclear plants caused by economic factors. Nuclear power also has the potential to play a role in reducing the cost of hydrogen production and is included in the technologies eligible for funding through the fuels and technology infrastructure, and the clean energy demonstration programs portions of the

legislation. Last, the legislation includes over $3.2 billion in funds for advanced reactor programs.

HYDROGEN

A net-zero carbon electric industry future will require a flexible, clean, and affordable fuel to ensure our electric grid remains reliable. Leading energy officials and scientists see hydrogen as a possible answer for the utility industry because many of the current power generation plants can be converted to burn hydrogen. In addition, as renewable resources grow, hydrogen could become a viable alternative to batteries for storing excess renewable energy production for use during other periods. The

problem is net-zero carbon hydrogen production, also called green hydrogen, is expensive to produce, lacks transportation infrastructure, and storage. Because current demand for green hydrogen is low, investment in green hydrogen technology and large-scale projects is lacking. The Act includes $8.0 billion to establish four regional clean hydrogen hubs to demonstrate the

production, processing, delivery, storage, and end-use of clean hydrogen. There is $1.0 billion targeted toward improving electrolyzer efficiency R&D, demonstration, commercialization, and deployment. Another $500 million is targeted toward advanced clean hydrogen manufacturing and recycling research/development.

BATTERY MANUFACTURING AND RECYCLING

Battery technology and availability of critical materials is a critical issue for competitiveness of US industries. Utility scale

battery storage is necessary to accomplish any net-zero carbon energy future. The June 2021 White House report, "Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth" identified the need to establish a resilient supply chain for critical materials to ensure US is able to secure critical rare earth metals for use in manufacturing parts, equipment and systems. Lithium Ion used in much of the utility scale battery systems, is a good example of a rare earth metal which will be in short supply, with projected growth of 4,000% by 2040. The act includes $627 million to establish rare earth demonstration facility, mapping of rare earth resources in the US, and research. The Act also includes programs to address lithium ion and battery recycling. One program provides $200 million to improve electric vehicle (EV) battery design, recycling, and second life applications. One potential second life application is the use of EV batteries in the utility industry for use in resiliency projects and other applications. The largest portion of battery funding included in the Act, $6.0 billion, is targeted toward battery manufacturing and recycling. The recycling effort is targeted at recovery of critical elements needed in battery manufacturing. The legislation also includes $505 million for energy storage demonstration projects.

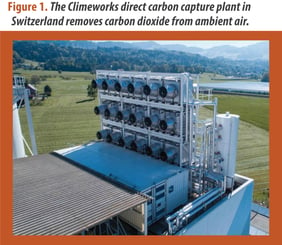

CARBON CAPTURE UTILIZATION & STORAGE

The technology to extract carbon dioxide from power plant or industrial process emissions has been around since the 1930’s. The process results in creating almost pure C02 that then must be transported and stored. The problem is where to place all the potential CO2 that could be removed from power and industrial processes and how to get it there.  The Act includes $12.0 billion of funding for various programs associated with carbon capture, utilization, and storage. Part of the incentive package includes funds ($350 million) for procuring products derived from captured carbon. There is $3.5 billion for establishing regional hubs for direct air CO2 capture and $2.5 billion for carbon storage and validation. The Act includes $2.1billion for Carbon Dioxide Transportation Infrastructure and Innovation program (CIFIA). The CIFIA program provides low interest loans for development of CO2 transportation systems. The Act also includes $4.4 billion for carbon capture demonstration projects.

The Act includes $12.0 billion of funding for various programs associated with carbon capture, utilization, and storage. Part of the incentive package includes funds ($350 million) for procuring products derived from captured carbon. There is $3.5 billion for establishing regional hubs for direct air CO2 capture and $2.5 billion for carbon storage and validation. The Act includes $2.1billion for Carbon Dioxide Transportation Infrastructure and Innovation program (CIFIA). The CIFIA program provides low interest loans for development of CO2 transportation systems. The Act also includes $4.4 billion for carbon capture demonstration projects.

CYBERSECURITY

The Act recognizes the importance of cybersecurity in protecting the US electric infrastructure from cyber-attacks. The legislation includes provisions for establishing self-assessment and auditing methods, establishing testing processes for cybersecurity products, technical assistance to utilities, and

cyber-attack response and recovery funding. It establishes a $1.0 billion grant program to fund state and local governments to assess cybersecurity risks. It also includes $100 million Cyber Response and Recovery Fund that can be used for reimbursement and technical assistance associated with cyber-attacks.

ELECTRIC VEHICLE CHARGING

Electric vehicle charging infrastructure is an important component for increasing the penetration of electric vehicles (EV) into the US automotive marketplace. The Act includes $2.5 billion grant program to strategically deploy publicly available EV charging stations in designated alternative fuel corridors and local community accessible areas. There is another $5.0 billion

for the Department of Transportation to deploy additional charging stations in designated alternative fuel corridors. This funding is going to directly impact the electric utility industry because of the need to provide electric service to the charging

stations. Public charging stations in designated alternative fuel

corridors are likely to be Level 3 DC rapid charger which can draw up to 400 kW per vehicle. If these charging stations are designed to serve at least 2-4 vehicles, the load could reach 1.2 MW per charging station or more at those locations.

NEXT STEPS

In addition to approving the Act legislation, the House is also

working on $3.5 trillion budget framework that includes programs of importance to the electric utility industry. Between these two legislative packages, there could be major changes in policies on climate and clean energy programs. Once all the legislation is passed into law, the various federal departments will need to turn the various legislation provisions into programs for implementation. Its good for electric utilities to follow the legislation activities because of the impact on various aspects of the business model. It is helpful to consider developing strategies regarding various facets of the legislation and the potential benefits that could be obtained for electric utilities retail customers.

For more information or to comment on

this article, please contact:

Rich Polich, Managing Director

Rich Polich, Managing Director

GDS Associates, Inc. - Marietta, GA

770-799-2453 or

rich.polich@gdsassociates.com

GET OUR NEWSLETTER

RECENT POSTS

- Why MOD-026-2 Matters: Raising the Bar for Generator and IBR Modeling Reliability

- Exploring the 2026-2028 Reliability Standards Development Plan

- Blackstart Resource Availability During Extreme Cold Weather Conditions

- DOE Pushes FERC to Accelerate Large Load Grid Access

- Building a Cyber-Aware Workforce in the Utility Sector

Archives

- December 2015 (8)

- June 2025 (7)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2024 (4)

- December 2024 (4)

- May 2025 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- September 2024 (3)

- October 2025 (3)

- December 2025 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- October 2024 (2)

- September 2025 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- July 2025 (1)

- November 2025 (1)

Categories

- Newsletter - TransActions (85)

- News (78)

- Employee Spotlight (35)

- Energy Use & Efficiency (28)

- Energy, Reliability, and Security (17)

- Other Specialized Services (11)

- Environment & Safety (10)

- Power Supply (8)

- Transmission (8)

- NERC (7)

- Utility Rates (7)

- Cyber Security (5)

- Energy Supply (4)

- Hi-Line: Utility Distribution Services (4)

- Battery Energy Storage (3)

- Uncategorized (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)