- Home

- Services

- Hi-Line Engineering

- About

- Careers

- Contact

- Requests For Proposals

Credit Ratings 101 | GDS Associates | Transaction Newsletter

by GDS Associates, Inc | February 9, 2017 | Newsletter - TransActions

In recent years, credit has come to the forefront within many segments of the US economy, including energy markets. Whether dealing with RTOs, lenders, contractual counter parties, or even customers, credit is increasingly becoming a major factor in deciding whether, and/or how, to transact with a particular party, and often impacts the terms and conditions of such a transaction. When evaluating the credit risk of an entity, credit ratings are often used as a basis of determining its credit quality or creditworthiness.

What exactly is a credit rating? Who provides a credit rating? What do “Ba1” or “BB+” or “CAA” ratings really mean? What’s the significance of an investment grade rating? How should credit ratings be used or interpreted? We’ll highlight some of the answers in this article.

What is a Credit Rating?

A credit rating is an assessment of a company’s ability to meet its financial obligations, or a measure if its credit risk or creditworthiness. It is not a guarantee that the financial obligation will be repaid, but merely a judgement or opinion by a rating agency regarding the likelihood of default. In general, credit ratings provide a relative ranking of the creditworthiness of a company, whereby a company with a lower credit rating is viewed to have a higher likelihood of default than a company with a higher credit rating.

History of Rating Agencies

Rating agencies, of one type or another, have been providing ratings to investors since the early 1900’s. In the mid-1930’s, the government decreed that banks could hold only investment-grade securities. This action initiated the delegation of risk assessment from regulators to rating agencies. Since then, increased regulatory requirements have forced banks, insurance companies, mutual funds, and other financial institutions to pay considerable attention to bond ratings. In 1975, to prevent just any company from selling investment-grade ratings to the highest bidder, the Securities & Exchange Commission designated Moody’s, S&P, and Fitch as the only rating agencies that may be used to satisfy creditworthiness regulations. Companies pay these agencies to rate them so that the companies can access the capital markets for debt and equity.

Role of Rating Agencies

Rating agencies determine and rate the creditworthiness of companies that issue public debt as well as the debt itself. The agencies conducts a fairly extensive analysis of a company to arrive at a rating. This analysis includes, but is not limited to : interviewing company executives regarding finances, operations, and management plans; assessing the business risk and competitive position of the company in relation to its particular industry; and evaluating a company’s financial risk by analyzing financial policy and characteristics, profitability, capital structure, cash flow protection, and financial flexibility.

Definition of Ratings

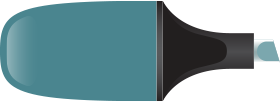

Moody’s S&P, and Fitch, all use letter-based rating systems. Figure 1 provides a summary of their rating symbols and associated definitions.

Use of Ratings

How are ratings used? Obviously, ratings are used to help determine the creditworthiness of a company or its debt. Ratings also play a role in determining the interest rate at which a company issues debt, as well as the price at which the debt publicly trades. Credit ratings are also used by investors, lenders, and contractual counter-parties as an important factor to assess the financial health and creditworthiness of a particular company. For example, the Rural Utilities Service (RUS) uses credit ratings as a means to allow its borrowers to convert from a traditional mortgage security instrument to an indenture by requiring investment grade ratings from at least two of the rating agencies.

Ratings are also used in various types of contracts as benchmarks to ensure proper credit quality between counter-parties. For instance, many contracts include material adverse change clauses that state if a particular party is rated and is downgraded by one or more of the rating agencies, additional credit support must then be provided, which may take the form of collateral, a parent guaranty, a surety bond, etc.

Ratings…play a role in determining the interest rate at which a company issues debt, as well as the price at which the debt publicly trades. Credit ratings are also used by investors, lenders, and contractual counter-parties as an important factor to assess the financial health and creditworthiness of a particular company.

The Significance of an Investment Grade Rating

Maintaining an investment grade rating is important to companies in many aspects. Inherently, it implies that the company in question has the ability to meet its debt obligations. As mentioned earlier, banks are only allowed to hold securities that are investment grade. So having investment grade status enables a company’s investor base to be broadened. An investment grade rating also gives investors increased confidence that the company is in good financial condition.

Not maintaining or achieving investment grade status can significantly affect a company’s operations and financial condition. For a company that fails to maintain an investment grade rating, credit “triggers” in contracts can be tripped requiring the company to provide additional credit support. For example, during the Enron debacle of the early 2000’s, several energy companies were initially downgraded by one or more of the credit rating agencies resulting in collateral calls to back existing contracts with counter-parties, which triggered further downgrades which, in turn, resulted in further collateral calls……the so-called “death spiral”.

Maintaining an investment grade rating potentially enables a company to issue debt at a lower interest rate. All things remaining equal, investment grade companies can issue debt at a lower interest rate than non-investment grade companies. As one moves down the scale of ratings from investment grade to speculative, the risk of default is seen to increase. As default risk increases, lenders must be compensated for this increased risk in the form of higher interest rates.

It should be noted that some companies never obtain an investment grade rating and may have no intention of reaching such status. This may be a result of the particular industry the company is in or possibly that management is willing to deal with the effects of not having an investment grade rating.

In Summary

Credit ratings can be a useful tool in determining the relative creditworthiness of a company as compared to its industry peers. The analyses and assessments conducted by the rating agencies provide useful information and insight on the credit risk associated with a particular company. However, as mentioned above, credit ratings provide no guarantees. Ratings are simply a prediction of how likely a company is able to meet its financial obligations based upon the credit assessment of the rating agencies. As evidenced by the subprime mortgage fiasco in 2008, there is no be-all and end-all measure in determining the ultimate creditworthiness of a company, and credit ratings are no exception.

For more information or to comment on this article, please contact:

Brian Lawson, Senior Project Manager | CONTACT

Brian Lawson, Senior Project Manager | CONTACT

GDS Associates, Inc. – Marietta, GA

770.425.8100

DOWNLOAD PDF

Also in this issue: Efficiency Moves Upstream

GET OUR NEWSLETTER

RECENT POSTS

Archives

- December 2015 (8)

- January 2016 (6)

- July 2016 (6)

- March 2021 (6)

- May 2022 (6)

- August 2020 (5)

- March 2015 (4)

- January 2019 (4)

- June 2019 (4)

- August 2019 (4)

- February 2020 (4)

- May 2020 (4)

- June 2020 (4)

- December 2020 (4)

- July 2021 (4)

- October 2021 (4)

- April 2015 (3)

- August 2016 (3)

- February 2017 (3)

- July 2017 (3)

- February 2018 (3)

- February 2019 (3)

- November 2019 (3)

- March 2020 (3)

- April 2020 (3)

- September 2021 (3)

- December 2021 (3)

- August 2022 (3)

- December 2022 (3)

- April 2023 (3)

- July 2023 (3)

- December 2023 (3)

- May 2014 (2)

- February 2016 (2)

- March 2016 (2)

- September 2016 (2)

- November 2016 (2)

- January 2017 (2)

- July 2018 (2)

- November 2018 (2)

- March 2019 (2)

- May 2019 (2)

- July 2020 (2)

- September 2020 (2)

- April 2021 (2)

- August 2021 (2)

- February 2014 (1)

- April 2014 (1)

- July 2014 (1)

- August 2014 (1)

- November 2014 (1)

- February 2015 (1)

- May 2015 (1)

- June 2015 (1)

- November 2015 (1)

- October 2016 (1)

- December 2016 (1)

- October 2018 (1)

- December 2018 (1)

- April 2019 (1)

- July 2019 (1)

- September 2019 (1)

- October 2020 (1)

- November 2020 (1)

- February 2021 (1)

- April 2022 (1)

- July 2022 (1)

- October 2022 (1)

- August 2023 (1)

- October 2023 (1)

- April 2024 (1)

Categories

- News (78)

- Newsletter - TransActions (75)

- Employee Spotlight (35)

- Energy Use & Efficiency (27)

- Environment & Safety (10)

- Other Specialized Services (8)

- Transmission (7)

- Cyber Security (4)

- Energy Supply (4)

- Power Supply (4)

- Hi-Line: Utility Distribution Services (3)

- Uncategorized (2)

- Utility Rates (2)

- Agriculture (1)

- Hi-Line: Seminars & Testing (1)